It’s a tactic employed by a number of manufacturers in the PV module market today: ‘Thanks to stringent internal quality assurance, our modules have an industry leading low rate of product warranty claims’. But is there more to the claim than pure marketing?

A typical warranty today covers around 80% of a module’s initial performance for a period of 25 years, often including specifications for performance loss in the first year of installation and each year thereafter. As manufacturers continue to compete on quality, and their customers benefit from lessons learned through losses resulting from light-induced degradation, potential induced degradation, microcracking and more, comprehensive warranty cover is very much a standard for the industry.

pv magazine Quality Roundtable at Intersolar Europe

Topics:

- Quality of glass-glass-modules

- Learning from a poor quality example about cable and connector quality

- Inverter after sales service and inverter performance

More information and free registration -> click here

Have you experienced difficulties around quality issues? Do you have an example of poor quality with inverters, plugs, cables and glass-glass modules and particularly poor after sales service? Share with us your substandard quality to discuss how we can overcome them. Complete confidentially is assured. Please email us, with Subject Line: Quality Case – to: michael.fuhs@pv-magazine.com

One manufacturer making big claims about its low warranty claim rates is Norway headquartered REC Group, which operates 1.5 GW of module capacity in Singapore. Cemil Seber, REC Group’s Vice President Global Marketing & Product Management told pv magazine that the company sees fewer than 100 valid warranty claims per million modules produced.

“We measure our warranty claims rate very precisely on a continuous basis,” he explains. “We like to make sure that that is transparent and clear in the market. But we see this [as being] very opaque in the industry.”

Chinese manufacturer Wuxi Suntech Power Co. also recently issued a statement that the proportion of complaints received by third party insurance providers regarding its products also amounted to only around 100 modules for every million produced. Both manufacturers attribute their low rate of warranty claims to stringent testing standards, both on their own manufacturing lines and those of their suppliers.

“We have good traceability of our BOM [bill of materials] in the value chain and we qualify and test that all perform at the same stringent level,” says Seber. “Any BOM that fails our level does not make it into our portfolio of raw materials.”

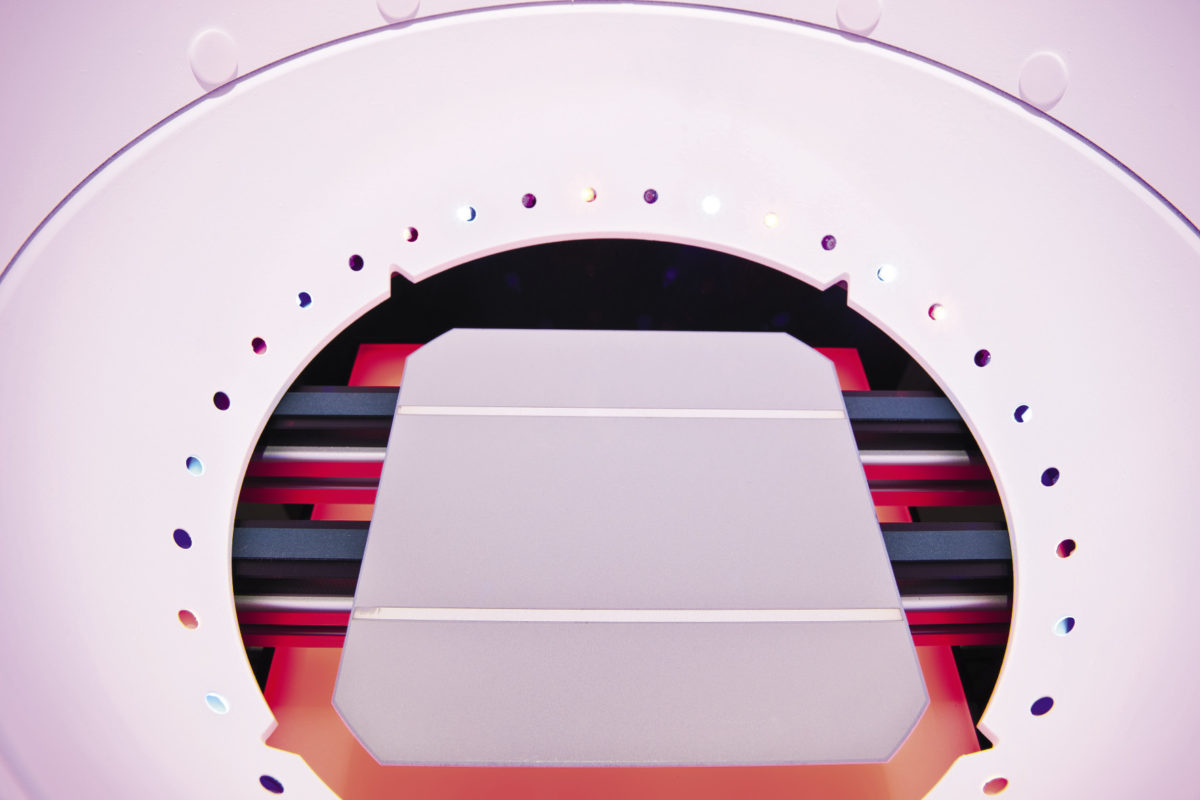

Assurance through technology

In production lines, manufacturers are increasingly deploying additional testing and quality assurance procedures at multiple stages in manufacturing. “Every Suntech solar module is subjected to a series of rigorous tests on the production line. Of particular note is the EL test,” said MR Fei, Manager of the Quality Assurance Department at Suntech. “Based on the EL of crystalline silicon, a high-resolution infrared camera takes near-infrared images of Suntech’s solar modules. Cracks, poor soldering, broken grates, and other defects that cannot be seen with the naked eye are detected, allowing hidden dangers to be removed from the beginning.”

But EL is hardly the highest of tech. The latest inline testing equipment is characterized as Automated Optical Inspection (AOI). AOI is more common in a number of industries outside of PV and generally involves high resolution cameras and fault detecting and reporting software. AOI can detect some faults using an algorithm, and while the equipment doesn’t come cheap, it can give manufacturers far better control over their processes.

Isra Vision, a Berlin-based company that supplies inline measurement systems, says it sees interest for such solutions from module manufacturers at present. “We are talking with a lot of customers in China right now, and they want to get rid of manual inspection, especially in module assembly,” says Tom Thieme, Business Unit Manager for Solar at Isra Vision. “Driving forces can be different. One is cutting labor costs, another is digitalization.”

Popular content

Thieme continues that many of these manufacturers are interested in fully automating quality assurance in their production lines, which is leading to some interesting discussions. Module manufacturers, he says, are interested in fully automating their quality approval procedures, but still uncertain as to putting all of their trust into software.

Another trend in quality assurance is the integration of testing at an increasing number of stages in both cell and module production. This again leads to more capex investment, but can allow manufacturers to more precisely pinpoint where optimization is needed and make adjustments before a faulty cell or module has been produced.

“End-of-line testing only can select for quality and not produce it,” says Richard Moreth, Head of PV Sales at Vitronic, a German-based provider of solar cell inspection systems. “To fulfill future quality requirements in the PV industry we see the necessity of inline automated optical inspection directly at each process step.”

‘Smart’ PV

Automating inline testing and adding further inspection stages to production fits in with many manufactures roadmaps for ‘Smart manufacturing’, where collecting and analyzing huge amounts of data at every stage is key to improving performance and quality – principles referred to as Industry 4.0. “Testing can create long-term insights when the generated test data is used and set into relation with the performance in the field over time,” explains Moreth. “Unforeseen performance losses can then be related to possible production inconsistencies and generate learnings for future production set-up. A track and trace system for the individual cell is also necessary for a consistent follow up of cell performance in the field.”

And though it may be early days for large scale and multi-stage AOI deployment in PV, equipment suppliers report increasing interest from tier one PV manufacturers. “We see a change right now in the industry, the big Chinese players are changing their minds from ‘we don’t care, we just do inspection and sorting at the end to’ to ‘we want to supervise our entire process chain and collect data from each step, to see where we have the most optimization potential,’” says Isra Vision’s Thieme. “This is a slow but growing trend.”

Thieme notes that some manufacturers have an interest in the ‘Smart PV’ trend, but a reluctance to be first to take the plunge. “Ensuring quality, in a self-learning environment, where based on certain data sets etc., the tools, the machines can learn for themselves – this is really a vision at the moment,” he says. “We are not there yet [in PV], but we have developments in the direction of AI, big data and smart learning algorithms.”

For REC Group, a high level of automation in manufacturing is essential to its quality assurance, and Seber says the company has measures to minimize human intervention during manufacturing for things like moving components between stations, and has integrated 100% EL testing, pre and post lamination, and automated recognition of EL cracks into its production lines. However, the company still sees a need for ‘eyes on a module’ in its inspection procedures. “We believe that both machine and human are complementary,” says Seber. “You won’t see EL cracks on a manual inspection, but scratches on glass, or on a frame etc. are better spotted visually.”

Post production

While these sophisticated inline testing methods can provide manufacturers and their customers with some assurance that what’s rolling off a production line is in line with promised standards, these modules often have a long way to go before reaching their installation site. REC’s Seber points out that a great deal of quality issues can also occur during transit. “In general, you see a lot of transportation and packaging issues, things like broken glass, scratched frames and backsheets,” he explains. “The customer won’t care if it was production or transport that caused the problem.”

There is consensus among the solar sector for ‘the more data the better’. But what’s done with the data remains an issue. A better understanding of the processes in manufacturing, in combination with how these products perform in the field, will surely contribute to better quality solar all round. “The more individual data you have about a module and how it was processed, the more reliable and trustworthily you can discuss with your customer any complaint or warranty issue,” says Thieme of Isra Vision. “I think this can be a driving force for collecting more data about individual process steps.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.