A fury of competition and innovation throughout the decade of solar's boom has largely perfected the job of turning DC power into AC. In 2022, improvements and refinements to the process are harder won. And as boom times prevail, the inverter industry continues to grow.

Yet 2022 wasn't a story of easy times despite demand. Supply chains still failed to keep pace, with most inverter manufacturers unable to cut down lead times to anywhere near pre-pandemic timeframes. Things are said to be improving in 2023, but choke points remain for key components including insulated-gate bipolar transistors (IGBTs) and advanced chips. And that story leads us to identifying some of the bigger trends throughout the year in inverters.

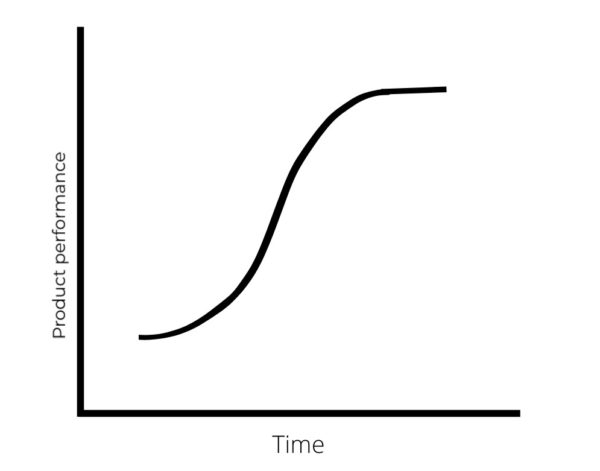

S-curve stalls

PV inverters are facing a typical late-cycle in a technology or innovation S-curve, where current technologies are mature, rapid improvements in DC-AC inverter technology have been made, and new gains are harder won.

At the opposite end of this typical S-curve is the hydrogen market, which is seeing rapid advancements in technology and products, with new gains easier to achieve through scale and investment.

However, PV inverters are arguably some way off reaching the tipping point of diminishing returns, thanks to an actively changing market. For example, at the residential and commercial level, many regions are embracing hybrid inverters as default to accommodate battery storage. Other examples include accommodating EV charging and, at some point, vehicle-to-grid solutions, as well as virtual power plant capabilities, smart controls and connectivity, and more. However, the core DC-AC conversion is mature.

All of this was evident in fewer step changes in products: new and better inverters came to market at all classes from a flourishing industry, but marketing departments were forced to work harder to explain benefits outside of raw efficiencies.

Elsewhere, high-power string inverters seen throughout 2020 and 2021 weren’t eclipsed in 2022 by even higher-power offerings, perhaps as weight and sizing limits were met. And, looking towards new technologies, silicon carbide semiconductor PV inverters continue to show considerable opportunity for the industry, but electric vehicles control the demand, costs remain high, and IGBT-powered inverter topologies in solar remain the dominant type.

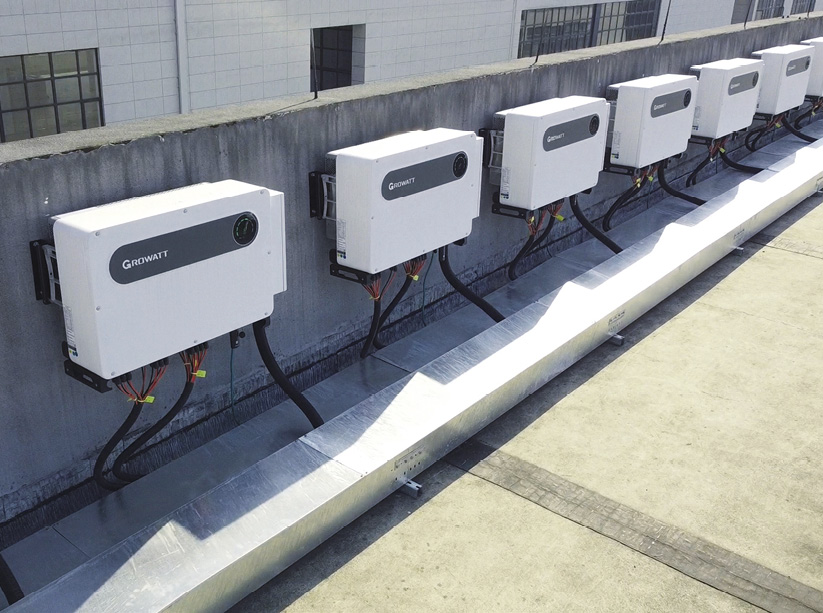

Manufacturing growth

Inverter manufacturing expanded significantly in 2022, despite the wide economic downturn and tougher conditions for businesses. Enphase committed to adding four to six new manufacturing lines, totaling around 4.8 GW to 7.2 GW of solar microinverter manufacturing capacity in the United States, provided it can secure funding via the production tax credit (PTC) system that is part of the Inflation Reduction Act (IRA).

Fronius also announced this year it will invest €230 million ($244 million) to expand production in 2023, with Martin Hackl, Global Director Marketing and Sales of the Solar Energy business unit at Fronius International, noting, “photovoltaics are in greater demand than ever before and the demand is exploding as a result.”

Central inverters

The central inverter market blossomed again in 2022 with multiple companies re-invigorating the market. Sungrow introduced a new “1+X” modular central inverter solution to the market, and Gamesa Electric won awards following the launch of its Proteus PV central inverter.

Sungrow’s option offered modularity at 1.1 MW increments up to 8.8 MW to meet the demands of project developers while promising higher energy yields, while Gamesa went for industry-leading efficiency from its Spanish-made inverter, with options scaling up to 4,700 kVA in a compact design.

New string inverters series launched throughout the year, but at utility scale, central inverters were some of the more interesting products entering the market.

Off-grid grows

2022 also saw inverter manufacturers turn niches into larger market opportunities: more off-grid inverters emerged into the market this year, and more inverters were certified to handle both on- and off-grid operation, adding some variation to grid-tie-only solutions. Intriguingly, manufacturers bringing their solutions to Europe and the US had previously established markets in regions like Pakistan, the Philippines, and South Africa, where power outages are more common. In response to both the energy market crisis and climate crisis, know-how from less grid-stable places became more useful.

Rule of thumb

As inverters reach technical maturity and both project and home owners aim for less maintenance and more longevity, 2022 saw some useful studies emerge as a guide to plant life. A study by Bern University of Applied Sciences shows that the performance of most PV inverters and power optimizers remains optimal for up to 15 years, the current industry rule of thumb anyway, after evaluating inverter failure surveys from 1,280 PV systems with 2,151 inverters, finding well-founded fears over inverters left in the causing faster aging.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hi there , although I have some history in domestic installations a while ago I’m new to off grid systems, I need to design a battery storage off grid system to power a small coffee shop . The main demand will be from the espresso machines, probably around 3 kw and the rest of the power to fun a fridge and a few peripheral appliances. I don’t want to go massive but would think 6 kw of solar would be my bare minimum needed . Would appreciate any advice regarding good companies, equipment and knowledge I should be looking at ?

I have 3 kw of EV panels and will be fine putting them together on mounts and configuring the arrays as necessary but the batteries, inverters and wiring is a little daunting.

Any advice gratefully received

I find PV-Magazine to be very informative, progressive and professional for the alternative energy enthusiast!