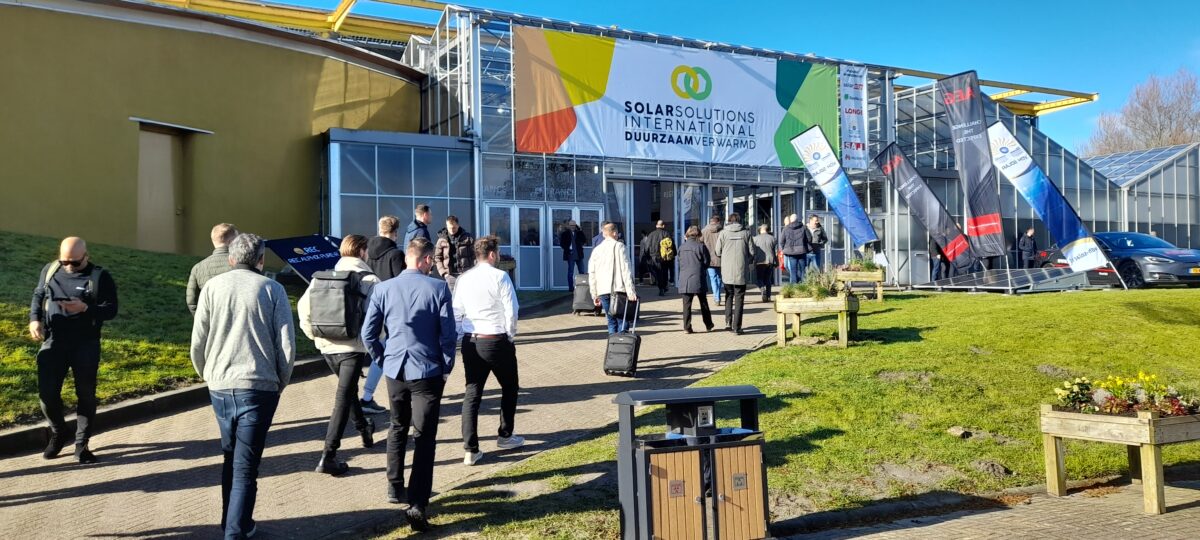

The Solar Solutions trade show in Amsterdam last week offered the same dynamic landscape of the previous editions, with growth in numbers and quality.

“The event covered a surface of 21.000 m2 and saw the participation of more than 300 exhibitors and 17.258 visitors,” Christian Sparborth, head of marketing and communications for Good! Events & Media, told pv magazine. “The number of visitors increased by 35% compared to the 2022 edition and the m2 climbed by 10%.”

Sparborth said the event organizer sees it as the first regular edition of the show since 2019. “This year we had a bigger section for heating solutions and heat pumps and we saw the offer for storage systems increase,” he said.

The Dutch solar market is currently stabilizing, but at a very high level, claimed Sparborth, noting that it is still twice as large four years ago. “Next year, the heat pump section will grow and will include more district heating technologies,” he said.

The Netherlands could have installed more than 4 GW of new PV capacity in 2022, according to provisional numbers, and this year demand could reach more or less the same level, said Wijnand van Hooff, general director of Dutch solar energy association Holland Solar.

“We have seen some Chinese companies coming back to the event after three years of absence due to the rules for Covid-19,” he said. “And we have also seen a lot of storage and EV charging, which shows the potential for creative grid management solutions.”

He noted how the event is responding to the well-known grid congestion issues of the Dutch grid.

“Grid congestion is an issue but it is not as big as grid operators make us believe,” he told pv magazine. “The technical boundaries haven't been reached yet, so there will be more deployment of large scale PV in the Netherlands in the future. Congestion management is the solution and is mandatory since November. However, it has not been used at all or at a very limited level so far.”

Van Hooff said that the utility-scale market will not come to a halt in the future, despite the current difficulties.

“We will probably see a shift from subsidized projects under the SDE++ program, which will have more complex requirements in the future, towards unsubsidized projects under power purchase agreements (PPAs),” he said.

As for the rooftop segment, which is currently being driven by net metering, Van Hooff said Holland Solar is currently supporting a proposal for a faster phasing out of the scheme, combined with a rebate program for storage systems that was launched in 2021 by Netbeheer Nederland and Energy Storage NL. They said solar capacity has been growing too quickly and that grid bottlenecks are becoming a serious issue, especially for the nation's low-voltage network.

“We believe that net metering should be phased out but gradually, without abrupt changes that could kill the market,” he said. “In the long term, it would be better for the sector. But we have to avoid what happened in Belgium, when net metering was closed when there was no battery availability and that killed two sectors at once.”

Van Hooff also claimed that solar manufacturing could come back to the Netherlands soon. “There is a very concrete plan for a 3 GW solar cell factory in this country under the MCPV consortium comprising nine companies,” he concluded.

Imfred De Jong, sales manager for Switzerland-based Meyer Burger, said the Solar Solutions trade show has provided an opportunity to meet many installers.

Popular content

“There is increasing demand for solar modules manufactured in Europe,” he said. “We see this coming from both consumers and enterprises.”

However, De Jong acknowledged that awareness of heterojunction tech advantages is still limited to some installers in the Netherlands. “We are mainly targeting the residential segment at this stage,” he said. “But we are also seeing increasing interest in the C&I business for these products.”

Jacques van der Bijl, director of technical marketing for Benelux at SolarEdge, noted the presence of a bigger heat pump section at the show.

“Our products are an ideal solution for combining PV power generation and heat pumps. We are seeing increasing demand for this combination, but net metering remains the biggest obstacle,” he said. “This scheme may probably be phased out but it is still uncertain what will happen and this is also a problem for the battery segment, for which the Netherlands is in a slow ramp-up.”

He added that the company is also hoping for a gradual transition, as an abrupt change could completely halt the market.

Adele Zhao, head of product solutions and marketing (EMEA) for Trina Solar, said the fair had more visitors than in previous years. She said she was surprised to see visitors from other countries, especially from Eastern Europe.

“The Dutch market will continue to grow, especially in the rooftop segment,” she said. “Grid and constraints currently represent serious issues for both subsidized large scale PV under the country's SDE++ scheme and unsubsidized projects under power purchase agreements.”

Linda Huang, sales director for Benelux and UK at Longi, said the company was able to meet all its strategic partners for both Belgium and the Netherlands at the event.

“Last year we shipped to the Benelux around 1 GW of products and for this year we are targeting 1.5 GW,” she said, noting that the biggest issue for these markets is currently the lack of manpower. “We are shipping mostly for the distributed generation market.”

Daniel Hofer, area sales manager for Austrian inverter manufacturer Fronius, said that many professionals attended the show to look for business opportunities.

“We are opening here new sales channels, especially as demand for European brands is growing,” he said. “Data security is also pushing more clients towards our products, with awareness in this regard increasing considerably among consumers. Supply, however, is still a limiting factor, due to supply chain issues.”

Matthijs Van de Water, manager of distribution and channels at Sungrow, said he was also able to meet companies from Spain, Portugal, Croatia and other countries.

“We see increasing demand compared to last year,” he said. “We still don't see big demand for residential batteries in the Netherlands so far, due to the presence of net metering. However, we are seeing strong demand in Belgium, where there is no more a net metering regime.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.