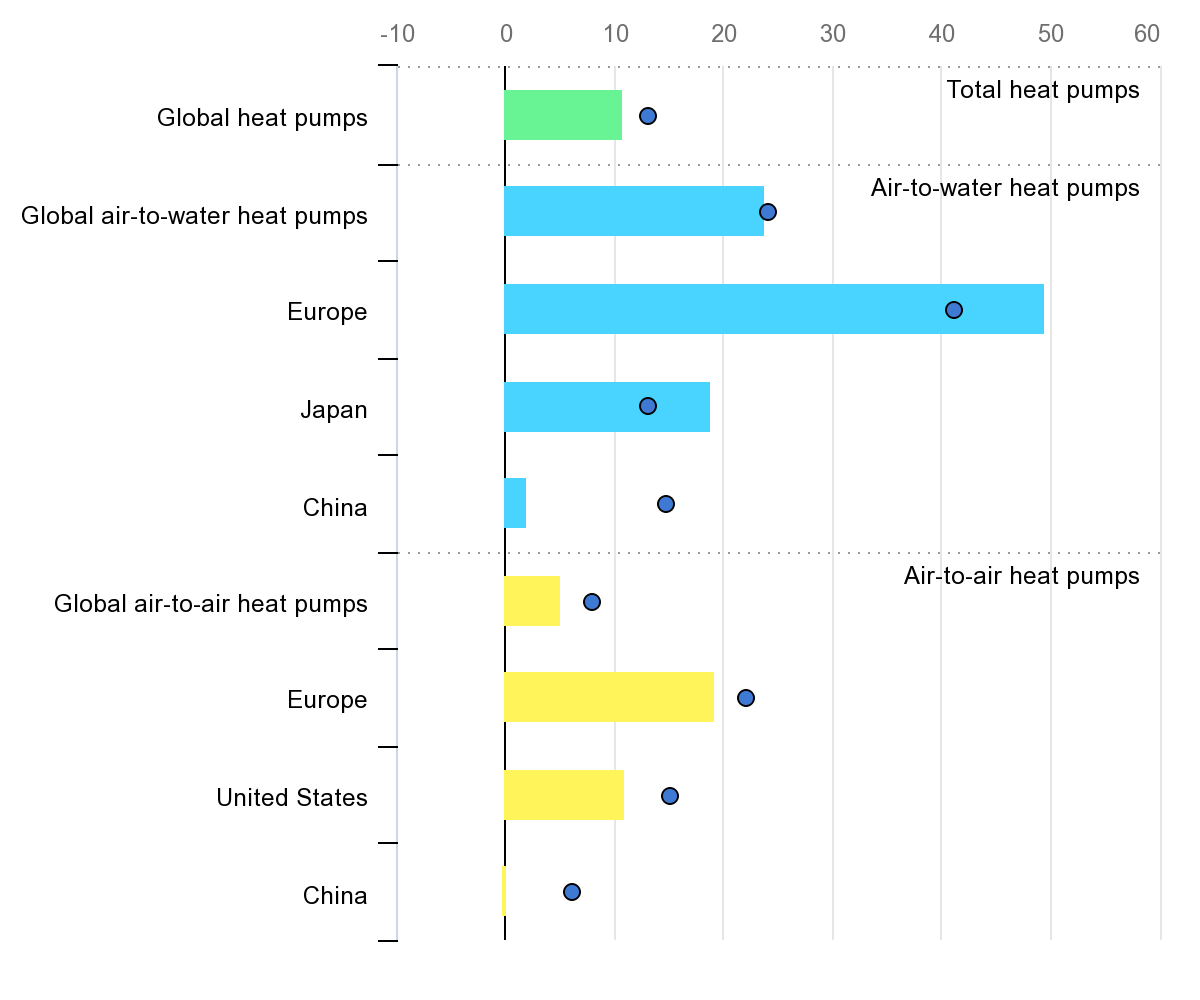

Global sales of heat pumps rose by 11% year on year in 2022, according to a new study by the IEA. Heat pumps cover around 10% of heating needs in buildings today, when they are used as a main heating device, said the agency.

“This corresponds to over 100 million households, meaning that one in ten homes that require substantial heating are served by heat pumps today,” the IEA said. “However, many more households use heat pumps only part of the winter or as a supplementary source of heating in regions where they are mainly used for cooling buildings.”

Across Europe, heat pump sales grew by 49% year on year in 2022. Nearly 3 million heat pumps were sold last year, with air-to-water devices proving more popular in Germany and Poland, and air-to-air units emerging as the technology of choice in the Nordics and the Baltic countries, as well as in Southern Europe. Italy, France, and Germany accounted for almost half of all sales in Europe, while the markets in Poland and Czechia doubled in size in 2022, according to the IEA.

Hybrid systems, which combine heat pumps and gas boilers, were reportedly a popular choice in Italy, as they accounted for more than 40% of sales in the air-to-water segment in 2022. While ground-source and water-source heat pumps are the most efficient technologies, they are also the most expensive and account for less than 10% of European sales, according to the IEA.

Heat pumps outsold fossil fuel boilers in French buildings for the first time in 2022, at a time when France introduced a national ban on gas boilers in new buildings. In the United States, heat pumps overtook gas furnace sales in 2022, after years of almost equal growth.

“Installations of heat pumps remain concentrated in new buildings and existing single-family homes,” the IEA said. “Apartment buildings and commercial spaces will need to be a priority area if solid growth is to continue.”

China manufactures around 40% of the world’s heat pumps, according to the IEA. The country is the largest producer and exporter of the technology, with most of its exports going to Europe.

The agency noted that continued growth in heat pump deployment will require secure and resilient supply chains. The five largest global manufacturers reportedly have their headquarters in the Asia-Pacific region. Supply chains for chips are particularly stretched thin at present, said the IEA.

The agency added that large-scale industrial heat pumps and district heating have a critical role to play in the decarbonization of heat. It noted that additional market statistics will be crucial to expanding deployment.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.