-

Chinese dominance to continue

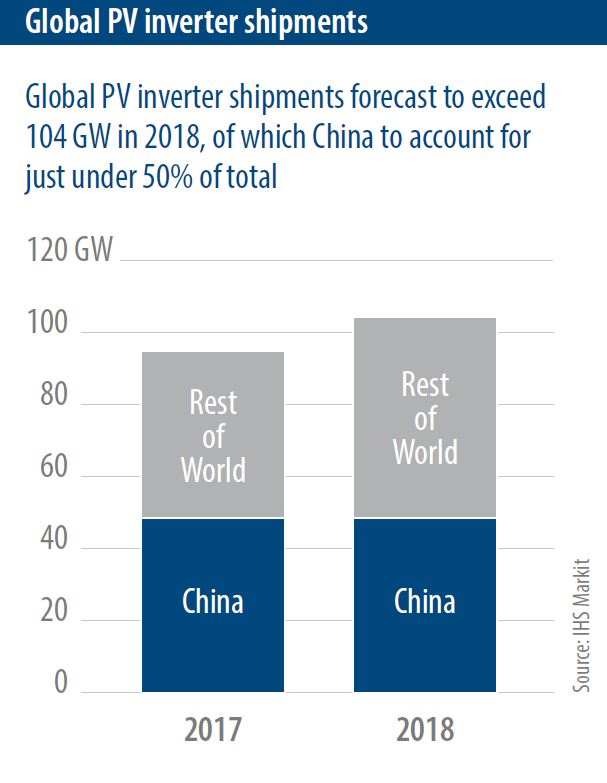

IHS Markit’s solar installation forecast for 2018 projects global solar PV capacity to grow by a further 108 GW, with China accounting for nearly 50% of that figure. For inverters specifically, Cormac Gilligan, IHS Markit’s senior solar analyst, believes that 104 GW will be shipped next year where, once again, China will represent just under half of total shipments.

“The market in China continues to perform very strongly, increasing by more than 50% in 2017 to deliver an incredibly strong year,” Gilligan said.

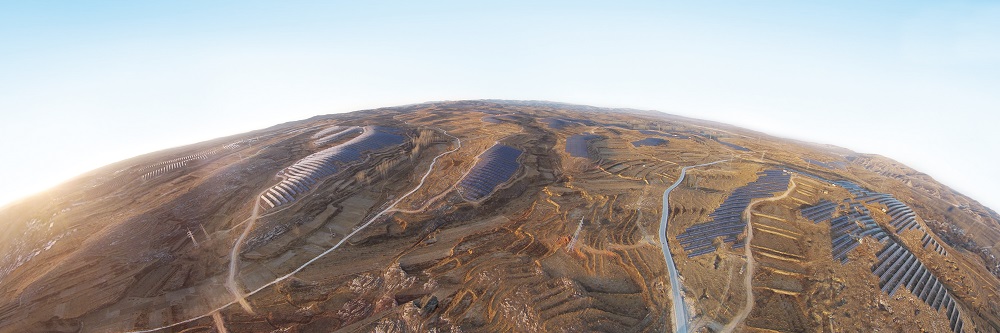

China’s dominance means that Chinese inverter companies have enjoyed domestic bliss in 2017, with around 75% of all shipments heading for the utility-scale sector. “There are few surprises in the names of the leading suppliers,” said Gilligan. “Huawei, Sungrow, TBEA, Chint, Sineng and KStar have all been dominant.” The big takeaway, however, has been the rapid rise of residential applications in 2017. While the total market is still relatively small, IHS Markit says that residential installations reached 2 GW in 2017, up from around 500 MW in 2016. “This has led to an opportunity for some suppliers that have been less able to gain foothold in the utility-scale market,” Gilligan revealed. “Brands that are strong in China’s residential space include Goodwe, Ginlong, Growatt and Trannergy, while Sungrow is also good at addressing China’s residential market.”

China’s dominance means that Chinese inverter companies have enjoyed domestic bliss in 2017, with around 75% of all shipments heading for the utility-scale sector. “There are few surprises in the names of the leading suppliers,” said Gilligan. “Huawei, Sungrow, TBEA, Chint, Sineng and KStar have all been dominant.” The big takeaway, however, has been the rapid rise of residential applications in 2017. While the total market is still relatively small, IHS Markit says that residential installations reached 2 GW in 2017, up from around 500 MW in 2016. “This has led to an opportunity for some suppliers that have been less able to gain foothold in the utility-scale market,” Gilligan revealed. “Brands that are strong in China’s residential space include Goodwe, Ginlong, Growatt and Trannergy, while Sungrow is also good at addressing China’s residential market.”

For many domestic inverter firms in China, carving out a viable share of the residential solar space last year was vital because in 2018 it is widely expected that Huawei will turn its attention to China’s private rooftops. “Huawei’s main focus in China so far has been at utility scale, but in 2018 we expect the firm to ramp up its move into residential, supported by the selective deployment of its power optimizer solution, which was unveiled to the U.S. market in 2017.”

Looking ahead, China’s residential market will continue to grow steadily, above 2 GW in 2018 as the country begins to place greater emphasis on its distributed generation (DG) market. “There will also be attention paid to collocating solar energy near to the bulk of demand, and that plays into the hands of rooftop developers,” Gilligan stressed.

-

Indian opportunities abound, but scale counts

Where China led in 2017, India followed with gusto. The nation surpassed 11 GW of new PV additions last year, and while some analysts believe a slight contraction is on the cards for 2018, the opportunities for inverter suppliers to ship in big numbers remain vast. However, the window for gaining a firm foothold in the country could be closing. “The big mover in India in 2017 was Huawei, which shipped more than 1.5 GW of its inverters in India last year and is now a leading player there as a result,” said Gilligan. The other leading players are Switzerland’s ABB, Germany’s SMA, Japan’s TMEIC and China’s Sungrow. However, it is only Huawei which is building with string at scale – otherwise, India’s vast solar parks are being built using centralized solutions mostly, Gilligan confirmed.

“This offers good opportunities for the big industrial players that all have centralized solutions, as well as Chinese firms. Having said that, Taiwan’s Delta has been successful with its string solution for the C&I space, and Huawei has laid the groundwork for string at scale in 2016, and their success could change the perception of what string inverters can do in India.”

Most of the big industrial companies now have local manufacturing in India, including SMA, ABB, Schneider Electric and Hitachi. “This makes them hard to dislodge, and so we could see market exits of some brands in the longer term,” Gilligan said. Currently, India resembles the Chinese market of three-to-four years ago, with a few key differences. “Smaller players are likely to find it harder in India than China. There is a tax for those that do not have domestic manufacturing, and that is proving challenging for project execution for some. There are very few domestic players doing anything near the volume of the bigger players, which are able to withstand the shocks that come when markets grow as rapidly as India’s,” Gilligan explained.

There is a push under Prime Minister Modi’s ‘Make in India’ program to support domestic manufacturing, which could help support some of the local producers. “Su-Kam is one of the leading Indian names in the inverter space: strong in off-grid and look like the biggest standout among domestic players.”

-

Size matters, but being nimble is key

Remove China from the figures for 2017, and what does the solar industry look like? The sheer volume of installed capacity in China didn’t just boost the industry: it skewed it too. India’s large-scale sector has behaved rather erratically, with module delays causing concern and low prices pausing development. In the U.S., too, uncertainty over the Section 201 case has prompted a lot of customers to query their inverter procurement capabilities in 2018, while severe price pressures in the markets of Latin America and MENA have made long-term growth projections tricky.

Image: Delta

“What all this market unpredictability means is that the ability to help customers procure, plan and grow across various regions becomes vital in 2018,” said Gilligan. And generally speaking, it is the larger companies – many of whom are more than just pure-play inverter firms – that are able to thrive. “The rush to develop at record-low prices in MENA and Latin America has led to some very big winners, but also some very big losers. Inverter suppliers have to have enough quotes and potential deals on the go at any one time just to win a few of them.” Generally, this makes it challenging to be successful quarter after quarter in winning project, particularly as the market becomes more fragmented.

Recent job losses at companies such as Siemens and General Electric (GE) would suggest that not even the largest firms are immune to these market realities, which proves that size and scale must also be complemented with an ability to be nimble and flexible.

“Yes, for big inverter suppliers markets like China, the U.S., Japan and India are still vital,” warned Gilligan, “but these multinationals also have to compete in Latin America, MENA, Australia etc, and this becomes challenge.” Chinese companies have something of an advantage here, he says, with the solid foundation of domestic strength underpinning globalization strategies.

The variability of the renewables industry delivers periods of shock and growth that are often unforeseen, which could play into the hands of a company like Siemens, which recently re-entered the inverter space with its new centralized solution. “Siemens has shareholders and profit targets, and renewables do not always offer the guarantees firms like this need. That said,” continued Gilligan, “as subsidies are removed and the sector becomes more competitive with traditional forms of energy, the scale of the projects being built is growing. So if Siemens can with supply and EPC contracts for 1 GW+ projects, while margins will be low the size of the installations means Siemens can make it work financially.”

A trend seen more widely in 2017 was the emergence and return of major utilities and oil and gas giants into solar, with EDF, BP, Enel, Total, Statoil and Shell all seeing the attraction in PV. “As solar costs become more competitive, you begin to see these players entering, which in turn attracts and reassures companies like GE and Siemens.”

-

MLPE landscape to harden, growth strategies to evolve

2018 will be a tougher market for module level power electronics (MLPE) players as Huawei ramps up its power optimizer solution globally,” believes Gilligan. “SolarEdge will continue to drive down costs with its HD Wave power optimizer solution, and Enphase likewise in the microinverter space with its next-generation IQ.”

Surviving and thriving in such a consolidated space will mean other firms – and those mentioned – may have to ramp up their partnerships with inverter and modules suppliers. “Prices for MLPE will continue to fall sharply this year, which is good news of course for the consumer, but for suppliers the key is continued integration and finding viable residential and C&I markets globally.” Curiously for the MLPE space, the leading solar markets of 2017 – China, India and to some extent Japan – remain largely untapped, although Enphase has drastically stepped up its presence in India over the past few months.

Perhaps the strongest trend shaping the MLPE space over the next few years is the growth of smart and AC modules, which are solar panels that have power optimizers (smart) or microinverters (AC) embedded in them. “These products reduce installation cost, speed up the install, and deliver a better profit margin to solar installers, so there are shared benefits,” said Gilligan. “Integration is carried out in the factory so usually the quality is better, and from a warranty and innovation perspective it is far easier for both MLPE and module providers to meet their objectives.”

Image: SolarEdge

The challenge, Gilligan admits, is for the customer base globally to become more familiar with the concept of smart and AC modules – and on this front the module providers have great responsibility, he says. “SunPower is growing its AC module rollout, and is a good example of successful synergy.

Can MLPE enter the promised land of utility-scale development this year? Gilligan thinks it is still too early for that. “Most MLPE suppliers work with premium companies in the residential and C&I space, where there is less price sensitivity. MLPE is still somewhat of a premium product, so we are still two-to-five years away from seeing any notable growth at scale for this technology.”

-

Modular design is making central solutions attractive

Central inverters have been enjoying something of a makeover in recent months. In 2017 the industry saw the growth of larger centralized solutions comprised in a modular way: that is, containers built using smaller blocks that allow greater design flexibility and improved redundancy. “This trend shows how central inverter suppliers are developing modular designs to help EPCs with their Opex costs,” said Gilligan. This makes it easier to steer the conversation away from Capex costs, which is an important market development in high-growth countries such as India and Mexico.

“Modular central inverters are an excellent solution that will see a steady embrace in 2018 as ECPs come to expect this option, which means good news for companies such as TBEA and Fimer that offer such solutions.”

Out soon: pv magazine January 2018

Be sure to order your subscription for 2018 today!

Something of a ‘third stool’ between the modular centralized design and the string approach is the virtual central inverter of the likes offered by REFUsol and Sungrow – who essentially house a bunch of string inverters together in big containers to offer a central point of control but the flexibility of string. “How much of a competitive advantage this approach offers remains uncertain,” explained Gilligan. “The benefits mean EPCs can optimize layout and enjoy an easier installation, but the argument as to how effective this approach is remains unclear. As things stand, the conversation tends to begin with ‘Do you prefer string or central?’ and then to take it from there.”

-

Beware of component shortages

Asked whether 1,500 volt (V) inverter technology is now a mainstay of the industry, Gilligan responded “definitely yes”. The trend has been long coming, and in 2018 IHS Markit expects 50% of all central solutions shipped to be 1,500 V. “String is further behind the curve, but Huawei is a leading proponent of 1,500 V string and is looking to penetrate new markets in 2018, while ABB and Yaskawa also have promising solutions.”

Less promising, however, is the threat of chronic component shortages derailing some expansion and innovation efforts, cautions Gilligan.

“Across the semi conductor space there have been component shortages,” he said. “Attributed to strong demand across many power electronics sectors such as EVs and smartphones, these shortages have caught some semi conductor suppliers off guard, and the indications are that there will be a shortage until the second half of 2018.” This has not yet impacted the inverter market, at least not in terms of the sector’s ability to meet supply demand. “But for utility projects it has delayed some completion and delivery dates, so this is something to keep an eye on later this year.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The biggest thing I see is,all inverters should include the battery back up option. As batteries get better and utilities get tough we,all need batteries. Micro grids will flourish and without battery options they will be out of business.