U.S.-based GTM Research has released its solar tracker figures for 2017. Overall, it says a record 14.5 GW were shipped last year, up from 11.6 GW in 2016, with NEXTracker Inc. assuming the leading position, accounting for a third of all shipments.

Array Technologies Inc. also maintained its position, ranking second; while First Solar Inc. was usurped this year by Spain's Soltec Renewable SL, which grew to become the third largest tracker supplier. Arctech Inc. and Convert Italia SpA, meanwhile, swapped positions, coming in fourth and fifth, respectively.

![]()

On the back of the Section 201 solar tariff uncertainty in the U.S. last year, the market was “significantly stunted,” meaning Latin America was recognized as the largest solar tracker market, for the first time, kicking the U.S. to second spot.

“Mexico and Brazil are two of the fastest growing solar markets in the world, each accounting for over 1.5 gigawatts of tracker shipments in 2017,” said Scott Moskowitz, senior analyst at GTM Research, and author of the study.

Despite the strong growth – 32% year-on-year – GTM Research said it still expects to see continued consolidation, with vendor margins squeezed as the market grows. It points to the acquisition of Exosun by steel giant, ArcelorMittal this January.

Looking ahead to 2018, the researchers forecast even stronger growth – 30% or up to 20 GW. “Fundamentals in the global utility-scale solar industry are excellent, and trackers are an obvious choice in most developing solar markets,” said Moskowitz.

Tracker trends

Last week’s pv magazine Weekend Read focused on how bifacial panel use on trackers is expected to grow to a double digit share within a year, and eventually become the dominant design.

Indeed, while bifacial panels may capture up to 10% more light than monofacial panels, single-axis trackers typically add 25% to that bifacial gain, resulting in a roughly estimated 12.5% gain from the two technologies combined, writes Charles W. Thruston.

“We are already being asked to quote these bifacial tracker systems for the 2019 timeframe,” Mark Preston, Vice President of Engineering at Array Technologies told Thurston in an interview.

“Next year there will be explosive growth in bifacial tracker installations,” predicted Guy Rong, CEO of Arctech Solar, based in Kunshan, while Dan Shugar, Founder of NEXTracker said, “The bifacial tracker is one of most exciting untapped opportunities in the solar industry; there will be a huge drive toward this.”

In January, meanwhile, Thurston reported on how the commercial and industrial (C&I) segment seems poised for exponential growth in tracking technology, on the back of advances in marketing with models like community solar, and advances in financing and technology.

Global tracker deployment

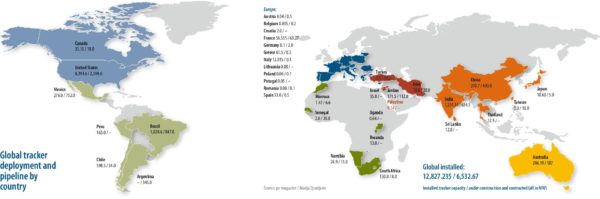

According to pv magazine’s latest annual tracker survey, published last July, and which analyzed data from 2016, the U.S. leads the global markets in terms of cumulative installed tracker capacity, at 8.39 GW, followed by India at 1.25 GW and Brazil, with 1.02 GW.

Overall, 12.83 GW of solar trackers were installed across the globe, at the time of the survey, while another 6.53 GW were either under construction or had been contracted. Click to enlarge the image below for a detailed geographical breakdown.

Watch out for pv magazine's 2018 solar tracker survey this summer.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“Indeed, while bifacial panels may capture up to 10% more light than monofacial panels, single-axis trackers typically add 25% to that bifacial gain, resulting in a roughly estimated 12.5% gain from the two technologies combined, writes Charles W. Thruston.”

I’m too stupid to understand this: single-axis trackers typically add 25% but if also bifacial, it is 2.5%. Could someone please explain.

Hi Csaba, thank you for your question. In your example the bifacial tracking module would boost gain vs fixed from +25% with monofacial to+35% with biracial.

best Shug

@Shug, I think you clearly meant bifacial not biracial:). Some cerebral glitch…..