As investment in the world’s energy sector remained on a downward trajectory for the third consecutive year, the total investment in renewables and energy efficiency declined by about 3% in 2017 following two years of increases, according to the International Energy Agency's (IEA) World Energy Investment 2018 report.

The downturn in renewables spending is expected to continue this year, following recent policy changes in China linked to a reversal of support for subsidized PV, warns the IEA, which notes China accounts for more than 40% of global investment in solar. China and the EU yesterday announced an intent to work together with a renewed urgency to combat climate change.

“Such a decline in global investment for renewables and energy efficiency combined, is worrying,” said Dr Fatih Birol, the IEA’s Executive Director. “This could threaten the expansion of clean energy needed to meet energy security, climate and clean air goals. While we would need this investment to go up rapidly, it is disappointing to find that it might be falling this year.”

While energy efficiency was the fastest growing sector – with a 3% increase in investment reaching $236 million – investment in renewable power, which accounted for two-thirds of power generation spending, dropped 7% in 2017, as growth in solar and offshore wind were undermined by declines in onshore wind and hydropower.

When combined, the two clean energy sectors illustrate the risk of slowing low-carbon supply investment, which the IEA says is a worrying trend.

The report also reveals the share of fossil fuels in the global energy supply increased for the first time since 2014 – to just under 60% – as a result of rising spending on oil and gas. Coal, gas and oil garnered $132 billion of investment.

Electricity and R&D

Underlining a trend towards greater electrification, the highest amount of global energy investments in 2017 – some $750 billion – was devoted to electricity generation and supply for the second consecutive year, outstripping the traditionally dominant oil and gas sectors, which attracted $716 billion.

Although electricity investment has shifted towards renewables, networks and flexibility, the expected output from low carbon power investments fell 10% in 2017 and did not keep pace with demand growth, the IEA found, and the report stresses more robust investment in renewables is needed in the light of a sharp fall in investment in new nuclear.

Popular content

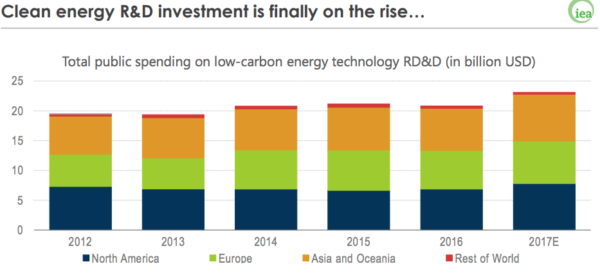

On the bright side, public spending on R&D for low carbon technologies rose 13% to $22 billion in 2017, after several years of stagnation, according to the IEA figures.

Policy trends

Across all power sector investments, more than 95% of financial backing is now based on regulation or contracts for remuneration, with a dwindling role for new projects based solely on revenues from variable pricing in competitive wholesale markets, according to the IEA.

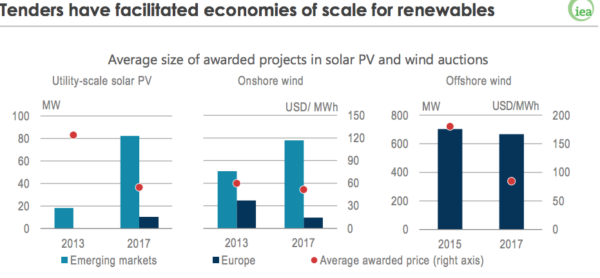

In terms of renewables, one of the chief mechanisms that have facilitated economies of scale are competitive mechanisms, such as auctions.

On the back of a massive drop in technology prices – which contributed to last year's decline in renewables investment – the average prices awarded in tenders plummeted, paving the way for bigger projects.

According to the IEA, the average size of awarded solar PV projects in emerging economies more than trebled, while that of onshore wind rose by half between 2013 and 2017.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

As alluded to in the article, the dip in total money going into the RE sector may be the combined effect of $/MWh decreasing while installation sizes increase (and thus total generating capacity) in addition to forcing effect due market maturation. Over the next few years, I would expect the investment numbers to rise again as investors realize that cost efficiency reductions are slowing down. While not the most positive new to have to rationalize, this dip was probably forecasted by someone in some model somewhere.

The fall in cash outlays on renewables is more than offset by the lower prices. The money buys more capacity each year..

What is worrying is that investment in renewables seems to have been stuck on a plateau for several years now. The stranded asset message has been taken, too late, in coal, but gas investors plough ahead as if there is no tomorrow. This may still be the case if they are not stopped in time.

For green energy investment, it would be sensible to include EVs, where large sums are being committed by battery and vehicle makers and their suppliers. The numbers of EVs on the roads (ca. 2m) is still too small to affect oil consumption significantly, but that will come.

The downturn in renewables spending is expected to continue this year