In 2010, electric vehicle (EV) battery pack prices came in at $1,100/kWh – this year they are averaging less than $156/kWh, according to market research company Bloomberg New Energy Finance (BNEF).

The plummeting cost of lithium-ion battery technology is being driven by growing EV demand and higher energy densities. BNEF forecasts that by 2024, total cumulative demand will pass 2 TWh to bring costs below $100/kWh. Once that happens, internal-combustion engines could be facing a crunch point with the economics slanting in favor of EVs for some vehicle segments and regional markets.

According to the report published by BNEF, $100/kWh is the price point at which EVs will begin to reach parity with internal-combustion engine vehicles. The study says continued reductions will be obtained through reduced manufacturing capital expense, new pack designs and evolving supply chains.

“As cell and pack prices are falling, purchasers will get more value for their money than they do today,” said James Frith, BNEF senior energy storage analyst and author of the report.

Low battery prices will be the crucial driver for the mass adoption of electric commuter cars but energy density – at cell and pack level – will also play an increasingly important role. BNEF noted the forces behind further cost reductions will become more foggy into the mid-2020s as there are many advances which could occur – whether in improved efficiency or new technologies and raw materials.

Popular content

Image: BloombergNEF

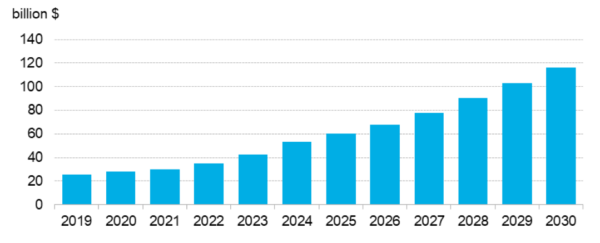

Regardless of the avenue taken, the lithium-ion battery storage market is projected to grow significantly over the next decade. Currently valued at less than $30 billion annually, BNEF forecasts the sector will grow to be worth $116 billion by 2030. And investment is moving quickly. While the EV battery market is dominated by Asian manufacturers, demand for e-mobility in the West is altering the supply chain.

New production announcements and expansion plans for manufacturing are on the rise in Europe and the Americas. This summer, China’s largest battery manufacturer, CATL, expanded investment to €1.8 billion ($2 billion) for its German gigafab and may also build a U.S. production facility. Last month, also in Germany, Tesla announced plans for its first European gigafactory, near Berlin. Plants such as those, located nearer to end consumers, will support cost reductions in transportation and import fees.

The benefits of increased energy density and cost reductions for battery technology will be felt well beyond transport as they aid growth in solar-plus-storage. The last two years has brought robust uptake of large scale battery energy storage adoption, particularly in the U.S. and Australia, where projects are moving forward to counter peak demand traditionally met by fossil fuels, and to provide grid balancing services.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The headline is misleading. EVs are already displacing ICEVs. Sales of the former are growing fast, but falling for the latter. In buses, EV market share is already high (half in China).. What is true is that the substitution is so far modest in overall scale. But we are not waiting for the magical “tipping points” beloved of pundits: it’s just steady growth.

Good article on lithium ion price point and parity point with ICE and EV. But there are other key points to be addressed if we have to enable the people to make mass changeover to EV.

1. Replacement cycle of batteries vs vehicle lifetime

2. Standardization of battery packaging and connecting system to move to replacing batteries at “battery stations ” instead of charging at charging stations. It is not possible to mass embrace the technology with charging stations as we have limitations in charging stations in cities with huge buildings.

So “battery stations” and battery replacement is the key wherein the car is driven to the battery station and in 10-15mins the driver drives away with a replaced another fully charged battery.

3. This means battery pack is owned by battery stations companies and is charged to customer at per charge basis.

4. The above infrastructure is mandatory to enable mass usage of EV as in EV , for the people Total cost of ownership and ease of moving seamlessly around is important.