The European PV market is growing from 65 GW to 75 GW this year and by 2028, a total of 462 GW of PV capacity could be newly installed on the continent, according to current forecasts from EUPD Research.

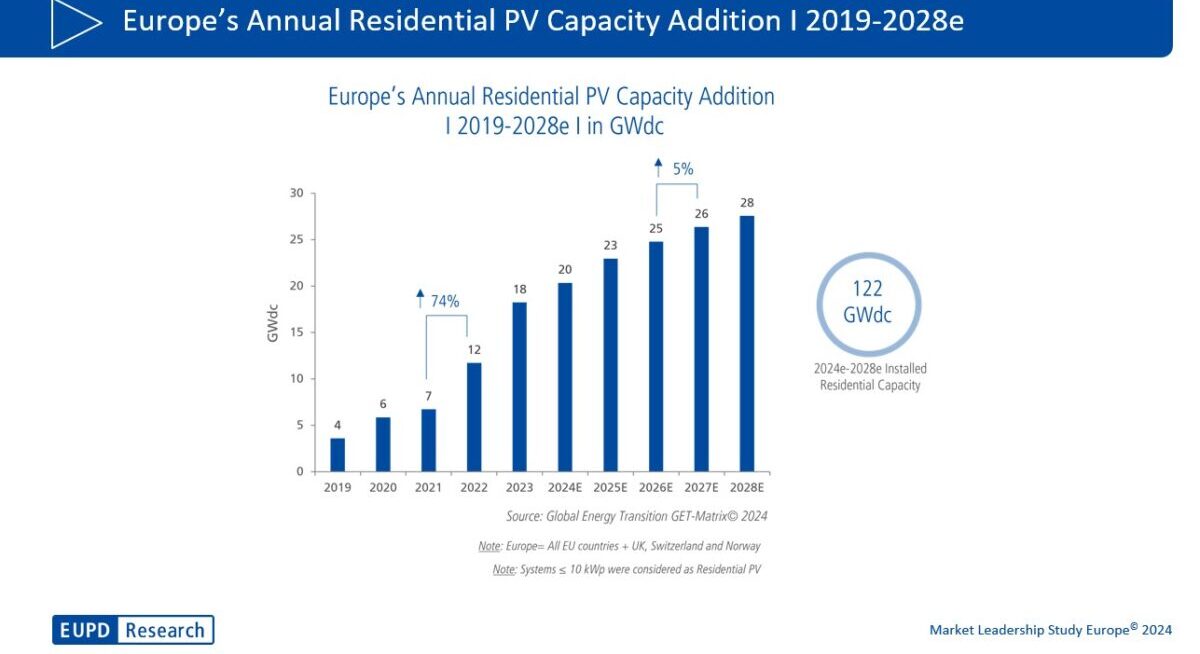

A key driver will be demand for private rooftop systems with an output of up to 10 kW. In this segment, the Bonn-based analysts expect an increase of 122 GW across Europe over the next five years, according to their current 295-page study “Market Leadership Study Europe.” The analysis focuses on 13 key European PV markets, including Germany, Italy and the Netherlands.

After the outbreak of the war in Ukraine, demand in the private systems segment picked up noticeably, particularly due to the sharp rise in energy prices. The expansion of small photovoltaic systems rose from 7 GW in 2021 to 12 GW in 2022 and finally 18 GW in 2023. This dynamic has already weakened and EUPD Research is therefore expecting growth rates of less than 10% for the next few years, resulting in an overall market in Europe of 28 GW in 2028.

In view of the optimization of solar self-consumption in many households, the installation of PV home storage systems has also become increasingly popular in recent years. EUPD Research expects an increase in installed storage capacity in the sector of more than 14 GWh this year. “As households try to counteract rising electricity and gas bills, a clear trend towards self-consumption is evident,” says EUPD Research CEO Markus Höhner. “Combined with the increasing popularity of electric vehicles and heat pumps, this trend creates a strong synergy for the use of photovoltaic technology in private households.”

The report also examines the competitive landscape of installers and finds clear fragmentation in Europe, reflected in the different levels of market maturity and acceptance rates in the various countries. Germany leads the way in Europe with around 6,300 solar installers. This is followed by Italy and the United Kingdom, with around 3,100 and 2,900 installation companies, respectively. This high number suggests strong market activity and widespread acceptance, according to the EUPD Research, which is seeing rapid development in the sector. Companies are constantly looking for new strategies to gain market share, such as flexible financing options, energy management solutions and dynamic tariffs that supplement their standard portfolio with PV systems, storage, wall boxes and heat pumps.

1Komma5° leads Top 30 installation companies in Europe

EUPD Research is also ranking European installation companies based on a comprehensive survey of around 15,000 firms and on a well-founded methodology that takes into account factors such as the number of systems and installations installed, geographical presence and product portfolio diversification. The methodology includes assigning specific weights to each variable in order to calculate the installer's final position and determine its position in the European ranking.

Leading EUPD Research's Top 30 list of leading European installation companies are 1Komma5°, Enpal and Zonneplan. The market leader has installed around 280,000 components and serves around 100,000 customers.

Hamburg-based 1Komma5°, founded in 2021, now has branches in Germany, Sweden, Finland, Denmark, the Netherlands, Spain and Australia, and is present in a total of 75 locations with around 2,200 employees. “We are very pleased with the result and, less than three years after our founding, we see ourselves strengthened in our strategy of building Europe's market leader both organically and through new acquisitions in a short time and, above all, profitably,” said CEO Philipp Schröder, commenting on the results of the report.

Project Solar UK and Soly Energy rounded out the The Top 5 list of installation companies. Among the Top 30 companies were the German firms Zolar, Energieversum, DZ4 and Eon as well as Swiss group Helion Energy.

“Through extensive primary and secondary research, EUPD Research has created a clear ranking of the 30 leading PV installers in Europe as well as the national champions in the 13 top markets,” adds Rajan Kalsotra, senior consultant at EUPD Research. “From multinational giants to national players, this diverse landscape underlines the prevailing dynamic growth and innovation in the European solar market.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.