With the clock ticking on the climate crisis, the longest UN climate talks on record wrapped up in Madrid with an agreement to increase the global effort to curb emissions. With the world’s nations expected to draft new action plans for the next big meeting, in a year’s time, the latest push for enhanced climate change pledges was opposed by some of the largest emitters, including China.

On the sidelines of the conference, however, a different message emerged from the latest China Renewable Energy Outlook (CREO) report. The study was prepared by the China National Renewable Energy Center and the State Research Institute and Energy Reform Institute, in cooperation with German Energy Agency dena, the Deutsche Gesellschaft für Internationale Zusammenarbeit and other institutes, thinktanks and universities from China, Germany, Denmark and the U.S.

The report stated China must step up renewables deployment to meet its Paris Agreement commitments.

In hard numbers, China needs to install an average of 58 GW of solar and 53 GW of wind power generation capacity per year from next year to 2025, the report found. That requirement was up from last year’s 44 GW and 21 GW for solar and wind, respectively.

Long shot

In terms of solar, the target figure surpasses even the stellar year of 2017 when China installed 53 GW of capacity. With only 17.5 GW of new solar added to the end of October, according to China Photovoltaic Industry Association (CPIA) figures, this year’s total appears unlikely to surpass 30 GW. Looking further ahead, the early signals suggest reaching such a target in 2020 could be a long shot too. Last week, the CPIA secretary-general revealed the slowdown will continue as he predicted only 40 GW of new solar would be added next year.

With subsidies for PV and onshore wind already being phased out, the changing regulatory framework is set to challenge developers in China over the next few years. Against that backdrop, new solar policies including feed-in tariffs (FITs) and the nation’s first solar auction under the FIT regime – as well as the removal of quotas in some provinces for grid-parity projects – have already had a significant impact on PV deployment.

To identify gaps between today’s policies and the 2050 vision, the CREO report envisages two scenarios for the Chinese energy sector: the ‘stated policies’ outlook, which assumes firm implementation of the policies announced, and a ‘below 2 °C’ scenario, which goes further in the reduction of CO2 emissions to support achievement of the Paris Agreement goals.

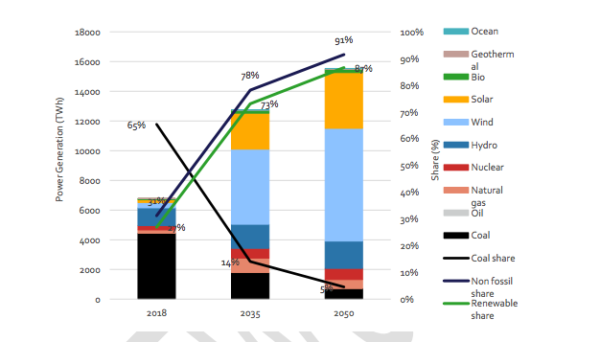

The more optimistic future outcome posits an electricity mix which is 78% non fossil fuel by 2035 and 91% in 2050. Solar and wind would account for the lion’s share of the transition, contributing 58% of electricity generation by 2035 and 73% by the latter date.

In that scenario, final electricity consumption would stabilize at current levels and direct fossil fuel use, such as in cars, would be replaced by electrification. New solar and wind generation capacity would have to be coupled with an 11% decrease in coal consumption and closures of inefficient coal-fired power plants and mines, the report stated.

Popular content

Satellite images published by advocacy group Coalswarm in September last year showed China was on track to add 259 GW of new coal-fired generation capacity to its grid. When fully commissioned, that would reportedly represent the equivalent of all the coal-fired capacity in the U.S.

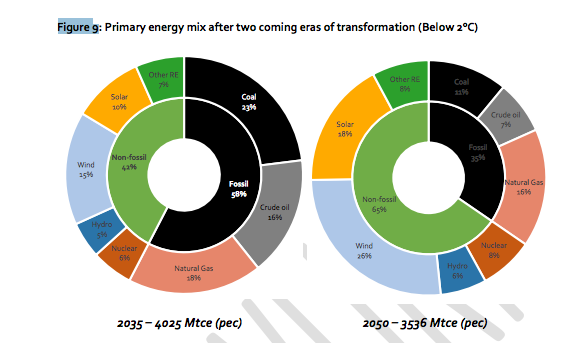

The CREO report’s energy transition scenario envisages coal’s contribution to primary energy consumption falling 62% by 2035 and 82% by 2050. That would mean coal’s share reducing from approximately 61% last year to 11% in 2050.

The proportion of non fossil fuels to primary energy consumption would be 47% by 2050 under the energy transition outlook and 59% in the more ambitious scenario and in each case would significantly exceed China’s official 20% target for such fuels in 2030. The logical conclusion to be reached, noted the study’s authors, is that the 2030 non fossil fuel target should be revised upwards as part of the 14th five-year plan, covering the period 2021-25.

Further ahead

As stated in the 13th five-year plan, which expires next year, an energy revolution is needed – more precisely, energy consumption and supply revolutions. The next five-year plan will recommend an average 111 GW of new solar and wind capacity be added annually and the CREO 2019 report adds two further suggestions for ensuring the energy transition.

The report recommends the 15th five-year plan should call for 116 GW of new solar capacity each year plus 127 GW of wind power and suggests the following five-year strategy should then propose 150 GW each of solar and wind projects annually.

The report considers cumulative solar generation capacity in China should hit 530 GW by 2025, to generate around 690 TWh per year. The figures necessary for wind are more-than-500 GW and 1.35 PWh.

The industry required to produce such a scale of infrastructure will inevitably result in a big carbon footprint. China, which has carbon emissions of just eight tons per capita – less than Germany (9.15 tons) and the U.S. (16.14) – has already committed to halting carbon emission growth no later than 2030 and the next five-year plan will go a long way to determining how swiftly that goal can be achieved.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.