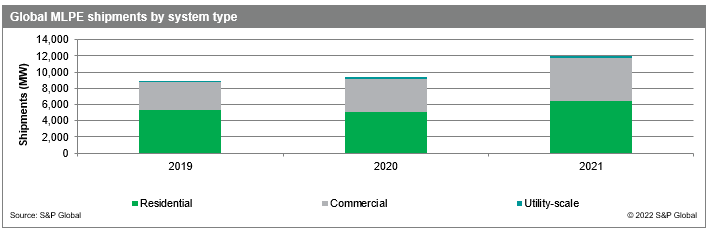

Around 12,000 MW of module-level power electronics (MLPE) were shipped throughout the world in 2021, mostly for the distributed-generation segment, according to a new report on MLPE by IHS Markit. The global MLPE market grew by 33% between 2021 and 2019, when around 9,000 MW of MLPE were shipped throughout the world.

IHS Markit said it expects cumulative MLPE shipments to reach almost 100 GW by 2026, with the United States, Germany and the Netherlands emerging as the top three markets. The report shows that one of the drivers for rising MLPE demand is the booming distributed-generation market, which is expected to account for almost 43% of global PV installations between 2022 and 2025.

“While the booming distributed-generation segment is definitely one of the drivers for high MLPE demand, markets that are less price sensitive and have mandatory rapid shutdown requirements or advanced grid requirements tend to be key markets for MLPE compared with markets where price is a more dominating factor,” Cormac Gilligan, director of IHS Markit, told pv magazine.

Strong demand from the distributed-generation segment is expected to drive MLPE prices down in the next few years.

“Also, as suppliers enter new geographies, prices are forecast to decline in order to obtain market shares,” said Gilligan. “However, the price declines are expected to be slower in 2022 and 2023 comparing with the following years due to the higher cost inputs owing to semiconductor and electronic component supply challenges.”

Popular content

The United States was the largest MLPE market in 2021, representing around 44% of global shipments. The country was the first to introduce module-level rooftop rapid shutdown requirements, followed by the Philippines. Other major PV markets such as China are reportedly also considering adopting such requirements.

MLPE is also becoming more common in areas where there are no rapid shutdown requirements.

“In recent years, the United States’ dominance in the MLPE market has been challenged by certain markets in Europe such as Netherlands and Germany, in South America such as Brazil and in Asia such as Australia,” the report said. “While consumers are not obliged to adopt these technologies, they have been persuaded by other benefits such as optimized yield, enhanced monitoring capabilities, and in certain cases, easier installation.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.