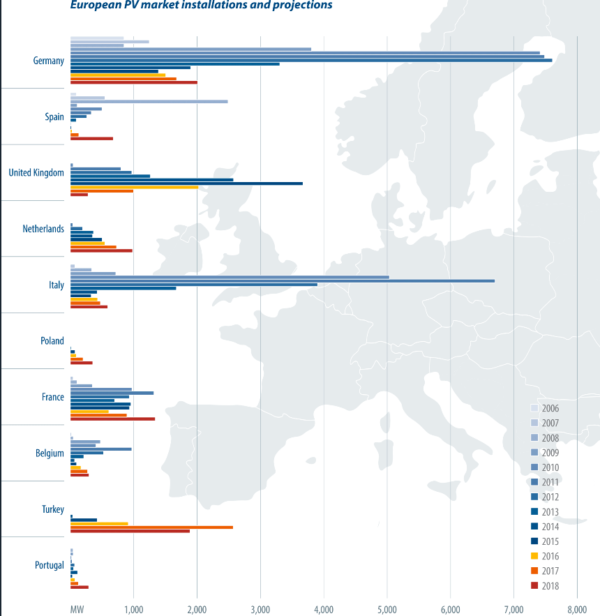

Solar installations in Europe picked up in 2017, with a total of 8.61 GW of new capacity connected – a 28% increase year on-year, and a five year high, according to IHS Markit. “In 2017, the European market has been impacted by the module shortage caused by the boom in the United States and China,” says Senior Solar Power Analyst Susanne von Aichberger. “In spite of these module restraints, Europe experienced the strongest demand since 2013.”

Turkey led this charge, installing 1.79 GW in 2017, which represents 213% growth, and pushed Germany, which installed 1.75 GW for 23% growth, off the top spot for 2017 installations. After these two, the numbers begin to fall. Indeed, while still the third largest installer, the United Kingdom’s 912 MW represented a 54% decline over 2016 figures, as support from government is scaled back further.

Elsewhere, the Netherlands is beginning to establish itself as a European leader; central European countries including Poland and Hungary have begun to move in the face of the European Union’s target to fulfill 20% of its overall energy needs from renewables by 2020; and Spain, though yet to be restored to its former glory, has recovered from a dismal 2016, with a modest 135 MW in new installations in 2017.

As 2018 unfolds, Europe looks to have returned to growth, with auctions announced across the continent, repowering projects going strongly in Germany and Italy, and strong demand for rooftop solar both in the residential and commercial sectors. “Spurred by tenders, existing incentive schemes, and self-consumption, IHS Markit projects European demand to grow significantly in 2018,” comments Von Aichberger. “Europe will gain global market share by 2022, but will not regain the importance it had before 2014.”

Turkey: Consolidation in progress

After a boom, comes the consolidation. Tukey’s reported 1.79 GW of solar installations in 2017 surprised many, however, it looks unlikely to be sustained through this year. The outlook for the market in 2018 remains relatively low, with around 700-800 MW of installations expected.

“We expect a number of manufacturers, suppliers, contractors and sub-contractors to get out of this business segment by the end of this year. Only the bigger ones, the more established groups, will continue,” says Altay Coşkunoğlu, Chairman of the Tekno Group of Companies, which is the parent of PV Engineer ing Procurement and Construction provider Tekno Ray Solar.

The company installed around 110 MW of solar in 2017, all unlicensed projects, and is focusing on the fast-emerging C&I segment in 2018 and looking forward to 2019. “There has been a new pricing scheme announced for factories that use a certain amount of electricity and on such levels they will be charged 15–40% more costly, or higher priced, electricity – which basically means that all of these industries will look into solar for self consumption needs on their rooftops,” adds Coşkunoğlu.

He notes that 200–700 kW C&I rooftop projects are very different beasts to groundmount, and that a number of EPCs with limited experience in executing rooftop projects will struggle to adapt. There remains a reported 600 MW of licensed projects, granted approval, but not yet executed that could be realized – however, some scepticism remains as to whether they will go ahead. There is, fortunately, some movement in the licensed project segment – some of them granted as long as four years ago. With the Turkish Lira now depreciated considerably, and the FIT paid in U.S. dollars, some of these projects are becoming attractive and will move forward throughout 2018, despite their high license fees.

The prospects of the large-scale segment will remain dependant on what direction the Turkish government chooses to take. There is some debate as to whether the Turkish government will choose to launch further “mega project tenders”, and it has identified regions – that go under the badge YEKA – in which projects such as the 1 GW Hanwha/Kalyon can be realized. Altay Coşkunoğlu believes that projects more in the order of 50-100 MW are likely to be tendered by the government, rather than the headline-grabbing gigawatt scale.

As for Turkish solar suppliers, contractors and EPCs in what will be a difficult period of market downturn, the surrounding regions present opportunities. “Turkish companies are very flexible in changing direction quickly,” says Coşkunoğlu. “They are very dynamic, not all of them, but the more international orientated companies like us. There is a lot of discussion about Iran, Ukraine, the Balkans, Macedonia, Kosovo, Africa, Afghanistan. Our company won a [15 MW] tender in Afghanistan [in JV] – and we will do that within the next few years.”

Germany: Back on track

The prevailing mood in the German market is positive. By last year, expansion had already picked up again, but at 1.75 GW it was still below the politically desired expansion target. The German Solar Industry Association (BSW-Solar) is convinced that Germany will be able to reach the 2.5 GW mark again this year. The figures for the first quarter give hope. At 580 MW of new capacity, the level was around 65% higher than in the first quarter of 2017.

“Prices in the PV market will remain under pressure,” says Martin Ammon of EuPD Research. That is why the analyst considers 2.5 GW of newly installed capacity a realistic target for this year, and expects this rate of expansion to continue in the coming years. IHS Markit’s forecasts for Germany in the current year are somewhat more cautious at over 2 GW.

For 2019, its analysts expect a slight increase to just under 2.2 GW. In addition to lower prices, BSW-Solar CEO, Carsten Körnig sees the renewed confidence of tradespeople and project planners in a stable policy environment as the cause underlying market revival in Germany. Moreover, the German government promised in its coalition agreement to issue tenders for 2 GW of PV in both 2019 and 2020. Currently, tenders for systems 750 kW or larger are issued 600 MW per year.

BSW-Solar is also calling for the annual expansion target to be raised, and existing investment barriers to be removed. Ammon already anticipates new difficulties for projects due to changes in the law. From the second half of the year onwards, the conditions for building ground-mounted PV plants up to 750 kW will become more difficult.

At the same time, the EuPD Research analyst said that the outlook for small and C&I roof-mounted systems remained “extremely positive.” At IHS Markit, Susanne von Aichberger, also sees this segment as an important market driver, citing current FITs and the attractiveness of self-consumption. By contrast, she sees uncertainty for market development in the announced special 2 GW tenders.

No corresponding regulation had been initiated for the tenders yet, she said, adding that projects would also likely take some time to complete. Despite this, von Aichberger believes that the special calls for tender could nevertheless give the German market additional momentum. It is therefore unsurprising that Körnig is demanding that, “The special calls for tender agreed to in the coalition agreement must be implemented quickly and without compromise.”

France: Leading status looms

After a dull 2016, the French PV sector recovered in 2017, with a 50% increase to reach 875 MW connected to the grid. This is the result of an ambitious policy initiated in 2015, aimed at bringing the installation rate in line with France’s COP 21 commitment. The goal materialized through a series of tenders with significantly larger volumes than those previously held. Since 2015, several calls for tender have been launched for more than 5 GW of solar capacity to be granted between 2017 and 2020.

In addition, a FIT scheme was established in 2017 for smaller systems including self-consumption PV arrays – the number of which has significantly increased since the program’s introduction two years ago. In 2016, 15,000 new self-consumption PV arrays were connected to the French grid.

Given installations fell short of the 2018 target, the government has added 1 GW of extra capacity to the ongoing tenders at the end of 2017. Additionally, the government called for a “solar working group” to meet between May and June, tasked with proposing solutions to simplify administrative processes and delivering an increased pace of PV development.

Regarding France’s renewable energy targets and anticipating the current “solar working group” conclusion, by 2023, the French PV market could reach an annual market of 3 GW, according to Xavier Daval, Chair of the French solar commission SER-SOLER.

Austria: Ambitious goals

In Austria, the government has managed to restore confidence. “Austria has a sensational government declaration that is unique in Europe. By 2030, 100% of electricity consumption will be generated from renewable energy sources, primarily from photovoltaics and wind, in addition to hydropower,” says Vera Liebl of Photovoltaic Austria (PVA). Yet, she also stresses that the Mission 2030 climate and energy strategy, which is currently being worked out, must now be brought to life. In its estimate for last year, the PVA expects that 170 MW of capacity were newly installed, and that this year the figure will top 300 MW.

Susanne von Aichberger forecasts similar growth figures for the current year and expects a further increase to 350 MW of newly installed PV capacity in 2019.

EuPD research analyst Ammon is not quite as optimistic, although he too speaks of a “positive trend.” According to his forecast, expansion should reach some 220 MW this year.

The strong market development in the current year is due in part to additional incentives. For instance, the government has earmarked a further €15 million for this year and next to promote photovoltaic systems and power storage. On the other hand, the previous solar subsidies for rooftop systems have been revamped. The share of self-consumption is taken into account to a greater extent, which means that more installations can benefit from the incentives.

From the PVA’s perspective, the elimination of the €0.015 per kilowatt hour self-consumption tax must be implemented quickly. “This would be possible with a simple stroke of the pen in the electricity fees act, and it will be our first litmus test of the seriousness of the government’s plans,” says Vera Liebl. The government has also promised a 100,000 roofs program, which von Aichberger sees as a possible market driver. “The government’s announcements still need to be fleshed out and implemented,” she continues.

According to The PVA association’s calculations, Mission 2030 will require an increase of 15 GW of photovoltaics by 2030. Given the current installed capacity of around 1.5 gigawatts, this represents enormous market potential in the coming years. According to the association, rapid launch campaigns and concrete funding targets are equally important for the government project.

Switzerland: Solid prospects

In Switzerland, too, there is hope of increasing expansion over the coming years. For 2017, the Swissolar association assumes that market volume will remain below the 264 MW recorded for 2016. EuPD Research also expects a slight decline for 2017, while IHS Markit expects expansion to hold steady at roughly the level of the year prior. This year, growth to around 300 MW is forecast and 400 MW could be achieved by 2020, says Swissolar CEO, David Stickelberger.

IHS Markit even forecasts an increase to just under 340 MW for Switzerland this year and a solid 380 MW for 2019. Swissolar identifies three main drivers of demand. Switzerland has made self-consumption possible for groups comprising several properties, although improvements still have to be made for tenant electricity projects. Stickelberger expects this to happen next spring. IHS Markit analyst, Susanne von Aichberger emphasizes that self-consumption of PV power is often profitable even without a one-time subsidy.

In addition, Switzerland is in the process of introducing a self-consumption policy for new buildings. The regulation will be implemented canton by canton and already applies in three cantons, Stickelberger explains. Three or four could follow this year, depending on the outcome of referendums.

Stickelberger also sees electromobility as an important driver for the Swiss PV market.

Swissolar faces obstacles that make it difficult to make an accurate forecast of how the market will develop. The waiting period for projects of less than 100 kW is currently around two years following the registration of a new photovoltaic system. For larger projects, periods of six to seven years are the norm. “This unsettles investors,” says Stickelberger.

With PV systems, there would also be an obligation to trade as merchant plants from 2020, which entails additional risks. In IHS Markit’s view, the fact that the cost covering feed-in tariff is no longer available for new projects also hampers market development in Switzerland.

Greece: Solar returns

Greece is preparing to tender 300 MW of new PV and 300 MW of new wind power on July 2, while more PV capacity will be tendered later in the year as well as in 2019 and 2020. Later in 2018, and into 2019, Greece is expected to tender an extra 800 MW of both solar PV and wind power projects via joint auctions. These will comprise 400 MW of capacity in both 2018 and 2019.

According to the latest statistics published by Greece’s electricity market operator Lagie, Greece has installed 2,094 MW of large-scale, ground-mounted PV and 351 MW of rooftop PV capacity. This capacity was mostly installed in Greece’s ‘golden’ PV years in 2012 and 2013.

Following a net metering scheme that resulted in just 16 MW of installations since December 2014, all eyes are set on the forthcoming auctions, with 20 year contracts for PV projects. Successful bidders will participate in the energy market, and will receive a variable premium. The premium will depend on market variables (e.g. the system’s marginal price) and the tariff set via the tender. This policy brings, at last, competition in the Greek renewable energy market.

Naturally, the more tender participants, the lower the tariffs will be, which is why energy regulator RAE ruled out that only adequately subscribed tenders will be realized. So, the tenders in July need to attract at least 75% of capacity on top of that being awarded.

Stelios Psomas, policy advisor at the Hellenic Association of Photovoltaic Companies (Helapco) tells pv magazine that this requirement was only 40% in the pilot auction. Helapco’s view is that the new required tender subscription level is irrational because there are too few mature projects that meet the tender’s license requirements.

Poland: A slow escape from coal

Despite low levels of installed solar power – approximately 280 MW – Poland is expected to auction around 750 MW of PV this year, which may further help Europe’s most polluting country reach more reasonable levels of renewable energy deployment.

This capacity will be assigned in 2018, in auctions not exceeding 1 MW. Larger projects may have good chances in other auctions for hybrid power plants for another 180 MW to be allocated. Another mixed wind solar auction is planned for this year, although local PV analyst, Piotr Pająk said that, most likely, this auction’s big winner will be wind with granted support for approximately 1 GW.

The launch of these tenders was made possible by an amendment to the Polish Renewable Energy Law introduced in March, a sign that more is being done for PV in Poland compared to the past. But in a country that still covers more than 70% of its demand with coal, and is probably doomed to miss its 2020 renewable energy target, there is room for many options.

Rooftop solar up to 40 kW under net metering has contributed considerably to the growth of PV over the past years and its push, combined with that of the aforementioned auctions, may raise Poland’s installed PV power up to 1 GW by 2020, according to PV Poland.

Coal, however, will remain hard to beat, as Poland’s market-wide capacity mechanism, which allows providers to be paid just for being available to generate electricity, has recently been approved by the EU.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.