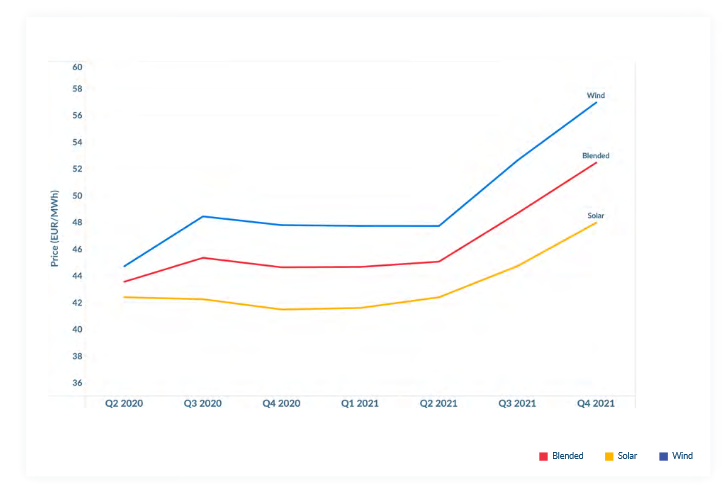

Renewable power purchase agreement (PPA) prices continued to rise in the last quarter on the back of a deepening European energy crisis that continued to drive wholesale electricity prices to new highs. Seattle-based renewables transaction infrastructure provider LevelTen Energy said the overall price index for European solar and wind PPA price offers rose 7.8%, from Q3 to Q4, with the cheapest 25% of deals reaching €52.46/MWh to mark a €3.78 quarterly rise.

The index series, compiled by LevelTen, analyses the thousands of solar and wind PPA pricing offers listed on the company’s Energy Marketplace across 21 countries in Europe and North America. In 2020, the company became the first to provide a global liquid PPA marketplace, that allows corporates to view and compare the risk and value of each PPA available in Europe and North America.

Via the UP Initiative, pv magazine is diving deep into the topic of what it means to be truly sustainable in the solar industry; looking at what is already being done, and discussing areas for improvement. Quarterly themes have thus far covered the use of lead in solar, raw material sourcing for batteries, green finance, circular manufacturing, PV module recycling, agriPV, and workers’ rights. Contact up@pv-magazine.com to learn more.Solar and sustainability

According to the U.S. company's Q4 2021 PPA Price Index, upward price pressure trends continued for a third consecutive quarter at the end of last year, totaling 17.4% over the nine months since March. Multiple reasons behind reduced PPA supply and rising prices include macroeconomic and regulatory challenges, including the energy crisis; as well as supply chain constraints; inflation; rising commodity costs; and a rising number of government renewables auctions, according to LevelTen. Consequently, Europe’s P25 Index – an aggregation of the lowest 25% of solar and wind PPA offers – now stands at €52.46/MWh.

While selling energy into wholesale electricity markets carries a degree of merchant risk, the current, sky-high wholesale prices are making that route an increasingly attractive option for solar and wind developers. “With wholesale prices being as high as they are, developers are raising their PPA prices to make up the revenue they could have otherwise made selling a greater percentage of their electricity on the day-ahead market,” said Fred Carita, LevelTen manager of developer services for Europe.

The crisis has reverberated across Europe to different degrees. Previously stable throughout most of last year, LevelTen's Italian P25 solar prices surged almost 21% in the last three months of the year. The country introduced regulatory changes in 2021 to simplify permitting and accelerate project development timelines but that has still not had any effect on PPA prices, with projects with a clear line of sight to commercial operation increasingly desirable to energy off-takers.

Popular content

Meanwhile, Spain experienced a short-term cool off with its fourth-quarter P25 solar prices rising 11.5% to €34/MWh as clean power developers adopted “wait-and-see” tactics. Consequently, the country’s percentage of total European offers on the LevelTen marketplace fell 12% from the previous quarter. That was due to the implementation of profit capping regulations in September, which reduced revenue from non‑carbon emitting plants and established excess remuneration would be determined on a monthly basis from the average price of Iberian gas. Private PPA prices have also been affected by plans for a 500MW government auction slated for April 6, which will allocate 200MW of concentrating solar generation capacity and 140MW of distributed solar, among other technologies.

An abundance of low-cost hydro insulated Nordic nations against upward price pressures but not uniformly. Power imported from Denmark left Sweden vulnerable to the impact of German wholesale electricity and PPA prices. Southern Sweden in particular is more exposed to central European market trends and the area saw rising PPA prices, with the nation's P25 wind tariffs going up 24% in the fourth quarter, to hit €36.48/MWh.

‘Encouraging'

Despite such headwinds, however, there was a 69% increase in annual PPA-contracted renewables capacity in Europe between 2020 and last year, according to industry group data, with non-standard contract structures such as upside sharing above a set price ceiling; delayed contract starts; and market-indexed PPAs rising in popularity.

“The good news is that PPA deals are still getting done,” said Rob Collier, VP of developer solutions at LevelTen. “Contract innovations tailored to current market conditions are enabling successful PPA transactions. And … buyers have so far remained undeterred by market conditions, meaning that demand is still high. Both of these facts are encouraging because it means that parties on both sides of the table are incentivized to find common ground.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.