On Monday the SNEC conference opened and included, as in previous years, the Global Solar Leaders Dialogue, which pv magazine moderated alongside Li Junfeng, chairman of the academic committee of China’s National Center for Climate Change Strategy and International Cooperation.

At the event, Tongwei president Hanyuan Liu announced his company’s strategic partnership with Longi Green Energy Technology, which promises to give Longi access to high-grade polysilicon while opening up Longi’s monocrystalline expertise and increasingly large production footprint to its partner. That was just one important example of the collaborations and consolidation moves that made for interesting discussion in the vast exhibition area of SNEC.

Another tie-up already reported by pv magazine involves Zhonghuan Semiconductor and GCL-Poly’s move to expand their production of mono wafers by 25 GW over the next three years.

SNEC also delivered a stream of rumors regarding prominent Chinese PV manufacturers being propped up by state owned entities or downsizing their PV businesses to better deal with changing market conditions.

A panoply of panels

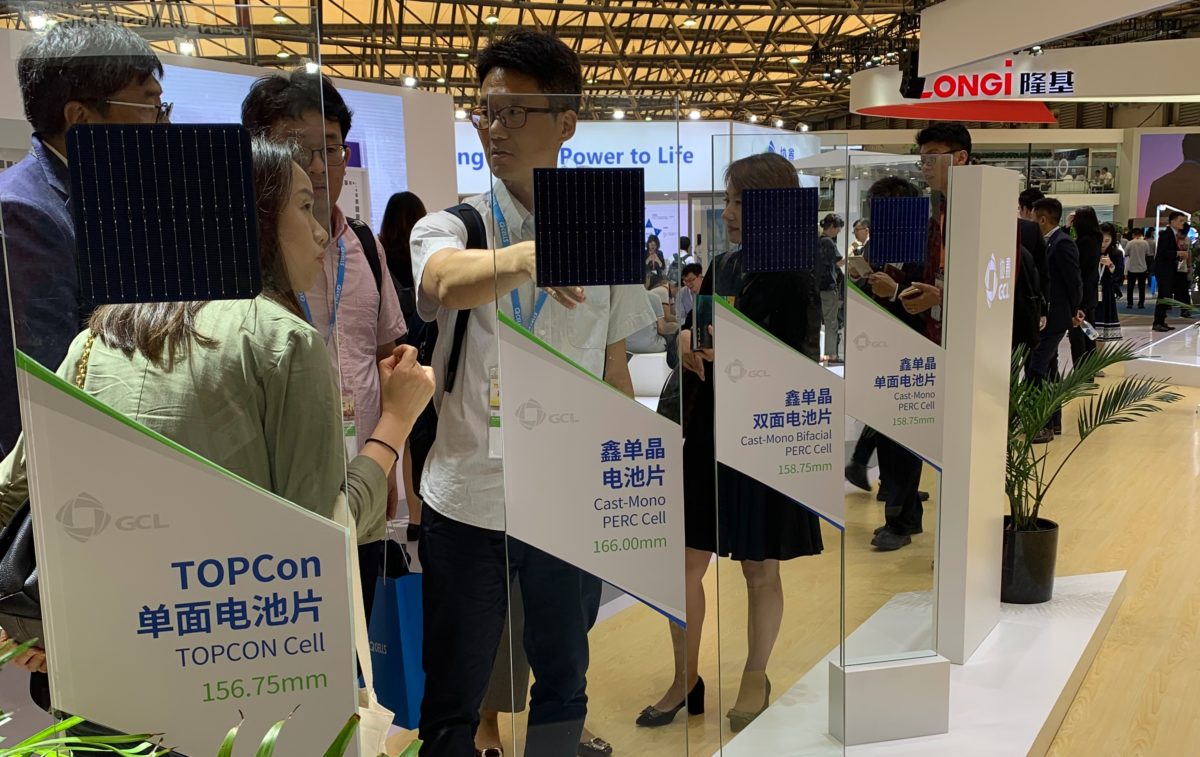

Continued innovation is one such market pressure and at SNEC 2019 innovation seemed to be occurring at a faster pace than seen at previous editions. Gone are the days when module manufacturer booths featured plain vanilla mono and polycrystalline panels – and in some case thin-film products. At this week’s SNEC – as at Intersolar Europe in Munich last month – stands displayed high-efficiency products with power ratings well beyond 300 W, and even 400 W. While PERC is the technology of choice, the modules on display typically offered much more. In some cases cells were shingled, in others half-cut, glass-glass or glass with transparent backsheets.

Heterojunction and TOPCon technologies also featured prominently and even perovskite cells made an appearance. Perovskite technology has come a long way in a short time but at the 13th Advanced PV Technology Plenary on Tuesday – part of the SNEC conference – Martin Green, a professor at the University of New South Wales, cautioned perovskites had yet to demonstrate the stability required for commercial production and still depended on lead to achieve high efficiency. Having lead in a module is by no means future-proof as more and more markets demand clean, sustainable products, he added.

Green also serves as chief scientist at Jiangsu Sunport Power Co., Ltd., a cell and module maker that has raised considerable capital to develop MWT – metal wrap through – technology. MWT high-efficiency modules represented another group of high-performance panels displayed at SNEC and one visitor told pv magazine most of them appeared to be Sunport products, even if branded differently.

Consolidation fears

While there is a burst of innovation among top-tier Chinese module manufacturers, companies with small margins and cash balances will be hard pressed to compete. Another trend seen at this year’s SNEC was the move to larger wafer sizes, with Longi Group chairman Baoshen Zhong telling pv magazine on Wednesday 30% of its cells next year will feature 166mm cells. Longi Solar’s latest Hi-MO 4 module – launched at Intersolar Europe last month – already features the development, which is almost 10mm larger than the previous generation, which included 156.75mm cells.

The move to larger wafer sizes will put additional pressure on module manufacturers with thin margins and weak balance sheets, since significant production equipment investment will be required to keep up with expanded formats. Further upstream, furnaces will need to be replaced to produce larger ingots to churn out bigger wafers.

On the downstream side, Zhong sees China’s market stabilizing at 40-50 GW next year and in subsequent years. That is higher than the figure he anticipates this year with the Longi chairman forecasting 35-40 GW. Zhing said most of those installations – around 25 GW – will come from next month onwards. He also predicted the first batch of grid parity projects announced by Chinese government last month, and amounting to just under 15 GW, would be installed by the end of next year.

Looking beyond China

That appears a somewhat optimistic prediction with some industry observers expecting a more protracted roll-out continuing until 2022 or even 2023. At this week’s SNEC, the contours of grid parity projects remained unclear and the coming weeks could bring further details about the latest attempt by the Chinese government to promote solar grid parity as part of its broader move to decarbonize its energy and electricity mix.

Last year’s SNEC will always linger in the memory because of the announcement by Beijing immediately afterwards of its ‘5/31’ policy to stem PV subsidy payments, a shock move which ushered in a period of uncertainty and change for China’s downstream PV market.

The industry is still not out of the woods and some observers caution this year’s installation figure may be well under 40 GW. Such uncertainty makes overseas markets all the more attractive for Chinese manufacturers. Whether from module, inverter or balance of system suppliers, there was plenty of interest at SNEC – both at the conference and on the exhibition floor – in markets including Australasia and Southeast Asia, the Indian subcontinent, the Middle East and Africa, a resurgent Europe which has an anticipated 80% growth rate from 2018 to 2019 and North, Central and South America.

All of those markets will benefit from the high-efficiency modules and other innovations displayed at this week’s SNEC, helping grid parity projects become increasingly the norm across the world.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.