With several nations jostling for prime position, who is leading the pack for lithium-ion battery supply chains?

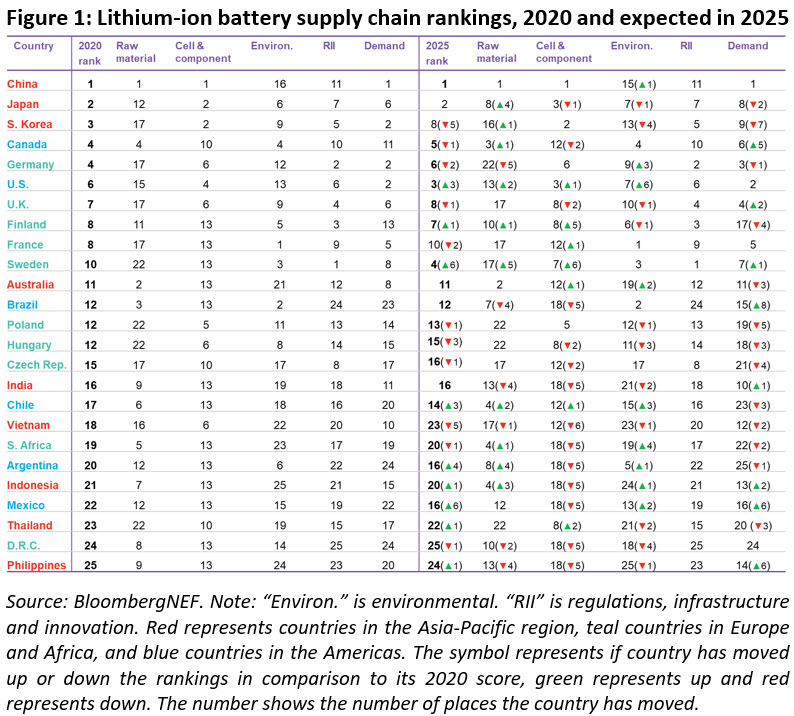

Analyst BloombergNEF has ranked the main contenders and found China is in the driving seat, at least for this year, having usurped former leading lights Japan and South Korea.

“Access to raw materials, talent and infrastructure are vital in attracting investment into the value chain,” said Kwasi Ampofo, BNEF lead analyst for battery raw materials. “In addition to making significant investments into mining of critical minerals all around the world, China is also the dominant player in materials refining. This has given it the advantage over Japan and Korea. Other countries seeking to be dominant players in the overall value chain may need to support upstream metals mining and refining development while also formulating policies that will safeguard the environment.”

With an estimated 72 GWh of storage demand, China controls 80% of the world's battery raw material refining capacity, 77% of cell production capacity and 60% of battery component manufacturing capacity, according to BNEF. With those sort of statistics, the analyst expects it to remain the world's lithium-ion top dog until at least 2025.

Energy storage

As part of pv magazine’s global UP sustainability initiative, we focused on raw material sourcing in the energy storage industry in Q1. You can read about lithium extraction in Chile, cobalt from the Congo and the development of raw material recycling. Contact up@pv-magazine.com to find out more.

“China's dominance of the industry is to be expected given its huge investments and the policies the country has implemented over the past decade,” said James Frith, head of BNEF's energy storage division. “Chinese manufacturers like CATL have come from nothing to being world-leading in less than 10 years. The next decade will be particularly interesting as Europe and the U.S. try to create their own battery champions to challenge Asian incumbents who are already building capacity in both places. While Europe is launching initiatives to capture more of the raw material value chain, the U.S. is slower to react on this.”

Germany was ranked fourth on the lithium-ion supply chain list, with the U.K., Finland, France and Sweden also making the top ten, albeit behind the U.S. and Canada. With the analyst including a five-year forecast in the ranking, it was estimated Sweden could top the European battery markets by rising to fourth spot during that period.

The sixth-ranked U.S. could reap the fruits of strategic investments and improve to third place within five years with BNEF noting the result of the presidential election in November could even offer the chance of the top spot, if the White House drives strategic raw materials investment and increased electric vehicle adoption.

Popular content

The importance of domestic policies is also demonstrated by the currently seventh-ranked U.K., said BNEF, with the decision to leave the EU meaning the nation's lithium-ion ranking will hinge on its ability to access the bloc's 152 GWh market, which is around five times higher than U.K.'s.

The advent of a border tax on carbon-intensive imports, such as that championed by the French at EU level and recently talked up by European Commission president Ursula von der Leyen, could also disrupt the BNEF rankings, as it would enable the localization of supply chains.

The analyst noted France's lithium-ion battery supply chain had the lowest CO2 emissions, at just 28g/kWh, last year. That is chiefly thanks to the nation's nuclear generation fleet, however, and with Brazil ranked second on the same criterion because of its hydropower facilities, a designation such as ‘eco-friendly' would be contentious to say the least.

BNEF also examined raw material access, cell and component manufacturing capacity, regulation, innovation and infrastructure, and domestic demand to determine the overall rankings, which are listed below.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.