Top News

Australian communities push back against big renewables

Germany launches new measures to support solar

The Hydrogen Stream: 1.2 TW of electrolyzers globally in development

pv magazine Webinar

pv magazine Webinar

MEDIA KIT 2024

Chinese PV Industry Brief: China may add 280 GW of new PV this year

China poised to reach 5.5 TW of solar by 2050

Schneider Electric launches new storage systems for microgrids

Key takeaways from Abu Dhabi’s World Future Energy Summit

SkyPower Global signs 1 GW solar PPA with Zambian utility

Press Releases

REEFLEX: Empowering Tomorrow’s Energy Landscape – A Year of Innovation and Growth

Sonnedix begins construction of its largest UK solar PV plant, providing 100 green jobs to local area

Better Energy more than doubled green energy production in 2023

Giga Storage announces Giraffe Energy Storage Project

Opinion & Analysis

Featured

‘I had a severe case of imposter syndrome’

Jet stream, prolonged monsoon shape March solar patterns across Asia

In a new weekly update for pv magazine, Solcast, a DNV company, reports that warm sea surface temperatures and disturbances increased onshore moisture along China’s southern coast, which in turn increased solar irradiance by 5-15% on long term averages.

Chinese wafer prices stable-to-soft amid high inventories

In a new weekly update for pv magazine, OPIS, a Dow Jones company, offers bite-sized analysis on solar PV module supply and price trends.

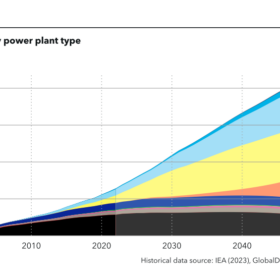

The fastest energy change in history still underway

In 2023, solar photovoltaics and wind comprised about 80% of global net generation capacity additions. Four times as much new solar and wind electricity generation capacity was installed in 2023 as compared with all other electricity sources combined.

At least 29 countries installed more than 1 GW of PV in 2023

IEA PVPS has published its new “Snapshot of Global PV Markets 2024” report, highlighting key insights and trends. Despite record installations, concerns over profitability and manufacturing dynamics persist, underscoring the need for strategic interventions and policy support to navigate towards a resilient and sustainable PV ecosystem.

When nano- meets climate technology

The use of metal-organic frameworks (MOFs) to create nanoscale crystal structures to attract hydrogen molecules could drastically improve the energy efficiency of storing and transporting the energy carrier.

Markets & Policy

Featured

Pexapark records 9.8% jump in European PPA prices for March

IEA calls for sixfold expansion of global energy storage capacity

The International Energy Agency (IEA) has issued its first report on the importance of battery energy storage technology in the energy transition. It has found that tripling renewable energy capacity by 2030 would require 1,500 GW of battery storage.

OCI increases production capacity at Malaysian polysilicon factory

OCI has revealed plans to invest $617.9 million to expand production at its Malaysian manufacturing facility from 35,000 to 56,600 metric tons.

India’s new solar installations hit 6.2 GW in March

India set a new record for monthly renewable energy installations by deploying 7.1 GW of capacity in March 2024. The monthly renewables additions included more than 6.2 GW of solar.

Perovskite PV cell, module manufacturing may face material supply risks

German and Swedish researchers calculated the supply of materials to produce perovskite tandem PV at a multi-terawatt-scale, flagging the difficult supply of gold, indium and cesium, well as a need to streamline production of certain materials used for hole-transport layers. “In essence, we might be able to go post-fossil fuels, but we can’t go post-minerals,” the research’s corresponding author, Lukas Wagner, told pv magazine.

Solar-assisted thermochemical heat pump based on caustic soda, water

Researchers in China have designed a two-stage, solar-assisted thermochemical heat pump system that uses caustic soda and water as a working pair. The system is reportedly able to achieve an energy storage density of 363 kWh/m3 and is considered by its creators an ideal solution for residential buildings with limited space.

Installations

Featured

Vena Energy energizes 125 MW of solar in Australia

US to upgrade power transmission infrastructure

As the US Inflation Reduction Act (IRA) ramps up clean energy efforts across the United States, the government has outlined a plan to expand transmission lines to accommodate more power.

Ireland introduces home energy loan scheme

The Irish authorities have presented a new plan to allow homeowners to borrow between €5,000 ($5,350) and €75,000 for up to 10 years, with low interest rates. Heat pumps, solar electricity and solar water heater installations are all eligible under the scheme.

Solar key to easing Burundi’s severe energy crisis

Burundi, the poorest country on earth, is unable to buy fossil fuels on theinternational market due to a lack of hard currency. pv magazine spoke with the United Nations Development Programme (UNDP) and a PV analyst to assess the true potential of PV in the nation’s current energy crisis.

Chemitek offers new cleaning products for floating PV

Chemitek has developed new cleaning products for floating PV arrays. The Portuguese company says it has tested and confirmed them to be safe for animals and vegetation around such systems.

TotalEnergies builds 12 MW solar carport at New York’s JFK Airport

French energy giant TotalEnergies has started building an onsite solar-plus-storage system at John F. Kennedy International Airport in New York City. It will provide energy to the Port Authority of New York and New Jersey and Con Edison, as well as community solar for area residents.

Technology

Featured

Korean researchers build 8 kW solid oxide electrolysis cell that can produce 5.7 kg of hydrogen per day

Improving solar panel recyclability with lasers

The National Renewable Energy Laboratory developed a proof of concept for a method to remove polymers from solar panel manufacturing to enable more efficient recycling.

Greek developer seeks consultants for Egypt-Greece interconnection studies

Greek renewables developer Elica SA is seeking consultants for two desktop studies related to an electrical interconnection project between Greece and Egypt. The undersea link will transmit green energy to Europe via a 3 GW HDVC connection.

First silicon solar cell celebrates 70th birthday

On April 25, 1954, US researchers presented the first prototype of a usable solar module. The efficiency at that time was around 6%. A lot has happened since then.

PV module fault detection technique based on convolutional neural network

An international research team has used the convolutional neural network (CNN) deep learning algorithm to identify faults in solar panels. Its work showed the proposed technique has a high degree of accuracy, especially if combined with transfer learning models.

Reducing photovoltaic-thermal module temperature with iron, copper oxide

An international research team has proposed using iron oxide and copper oxide to lower photovoltaic-thermal (PVT) solar module temperature. Their analysis showed that the two compounds were able to lower the panels’ operating temperature by 23.49% and 34.58% respectively.

Manufacturing

Featured

European Parliament votes in favor of Net-Zero Industry Act

Huasun presents ‘zero busbar’ heterojunction solar modules with 23.8% efficiency

The Chinese manufacturer launched two new module series for utility scale applications. The new products feature a temperature coefficient of -0.24% per C and a bifaciality factor of over 85%.

Solarge plans 500 MW BIPV module factory

Dutch module manufacturer Solarge has raised €3 million venture capital from new and existing investors to expand its recently opened facility where it produces lightweight, low carbon, panels for commercial and industrial rooftops.

SunPower to close business units, cut about 26% of workforce

The US-based company announced plans to wind down its residential solar installation locations and close its direct sales unit.

South Korea offers support for agrivoltaics

The South Korean government has announced a new package of measures to support agrivoltaic projects. It says that the agrivoltaics business should be a priority for agricultural companies.

JinkoSolar posts $1 billion net profit for 2023

Chinese module manufacturer JinkoSolar has recorded roughly $16.4 billion of revenue and a $1.06 billion net profit for 2023, with PV module shipments reaching 78.52 GW. Its module manufacturing capacity hit 110 GW at the end of December.

Energy Storage

Sodium-ion battery could charge in several seconds

AfDB identifies key priorities for minigrid deployment in Africa

An African Development Bank (AfDB) report covering critical takeaways from the ARE Energy Access Investment Forum 2023 says that challenges in financing, policy, technology, and skills enhancement must be overcome to support the deployment of distributed renewable energy minigrids across Africa.

Indian startup develops sand-based gravity energy storage system

Baud Resources, a clean-tech startup, has developed a gravity energy storage mechanism that uses locally available materials such as sand and industrial waste as its payload. The company is building a 100 MWh pilot plant that will reportedly offer a levelized cost of storage of around INR 2.5 ($0.03)/kWh.

Norwegian startup unveils CO2 water-to-water heat pump

Tequs said its new plug-and-play heat pump can deliver up to 90 C of heat for space heating, air conditioning, and domestic hot water. The new product is available in eight versions with capacity ranging from 17 kW to 268 kW.

Battery makers oversubscribe India’s latest 10 GWh tender

The Indian authorities say the nation’s latest 10 GWh tender was oversubscribed. It attracted seven bidders, including ACME Cleantech Solutions, Reliance Industries, and Waaree Energies.

Australia announces community battery rollout

The Australian federal government’s initiative to install 400 community batteries across the nation has reached the Australian Capital Territory, with plans for three new battery energy storage systems.