Top News

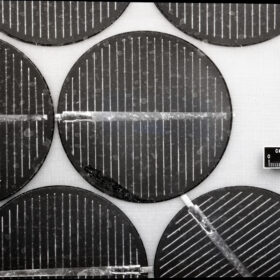

Improving solar panel recyclability with lasers

European Parliament votes in favor of Net-Zero Industry Act

Ireland introduces home energy loan scheme

pv magazine Webinar

MEDIA KIT 2024

Greek developer seeks consultants for Egypt-Greece interconnection studies

First silicon solar cell celebrates 70th birthday

Solar key to easing Burundi’s severe energy crisis

PV module fault detection technique based on convolutional neural network

Reducing photovoltaic-thermal module temperature with iron, copper oxide

Press Releases

Sonnedix begins construction of its largest UK solar PV plant, providing 100 green jobs to local area

Better Energy more than doubled green energy production in 2023

Giga Storage announces Giraffe Energy Storage Project

Menlo Electric Launches Roadshow Across Central Europe

Opinion & Analysis

Featured

The fastest energy change in history still underway

At least 29 countries installed more than 1 GW of PV in 2023

IEA PVPS has published its new “Snapshot of Global PV Markets 2024” report, highlighting key insights and trends. Despite record installations, concerns over profitability and manufacturing dynamics persist, underscoring the need for strategic interventions and policy support to navigate towards a resilient and sustainable PV ecosystem.

When nano- meets climate technology

The use of metal-organic frameworks (MOFs) to create nanoscale crystal structures to attract hydrogen molecules could drastically improve the energy efficiency of storing and transporting the energy carrier.

Solar module prices hovering at all-time lows

As solar module prices continue to fall, pvXchange.com founder Martin Schachinger explains how price pressure could increase in the weeks and months to come.

Dust and cloud impact solar across Arabian Peninsula

In a new weekly update for pv magazine, Solcast, a DNV company, reports that dust storms and slear skies led to contrasting March Solar Performance in West Asia. The Arabian Peninsula experienced humid winds and dust storms that reduced solar irradiance to 90% of typical levels for the month.

‘Paternity leave policies are strongly correlated with the female share of board seats’

In another article of a series on gender equality, Women in Solar Europe (WiSEu) gives voice Mariyana Yaneva, Vice Chair at the Association for production, storage and trading with electricity (APSTE). She explains that policies allowing childcare needs to be met but not placing the burden of care explicitly on women, increase the chances that women can build the business acumen and professional contacts necessary to qualify for a corporate board.

Markets & Policy

Featured

TotalEnergies builds 12 MW solar carport at New York’s JFK Airport

AfDB identifies key priorities for minigrid deployment in Africa

An African Development Bank (AfDB) report covering critical takeaways from the ARE Energy Access Investment Forum 2023 says that challenges in financing, policy, technology, and skills enhancement must be overcome to support the deployment of distributed renewable energy minigrids across Africa.

Indian startup develops sand-based gravity energy storage system

Baud Resources, a clean-tech startup, has developed a gravity energy storage mechanism that uses locally available materials such as sand and industrial waste as its payload. The company is building a 100 MWh pilot plant that will reportedly offer a levelized cost of storage of around INR 2.5 ($0.03)/kWh.

Norwegian startup unveils CO2 water-to-water heat pump

Tequs said its new plug-and-play heat pump can deliver up to 90 C of heat for space heating, air conditioning, and domestic hot water. The new product is available in eight versions with capacity ranging from 17 kW to 268 kW.

Solarge plans 500 MW BIPV module factory

Dutch module manufacturer Solarge has raised €3 million venture capital from new and existing investors to expand its recently opened facility where it produces lightweight, low carbon, panels for commercial and industrial rooftops.

SunPower to close business units, cut about 26% of workforce

The US-based company announced plans to wind down its residential solar installation locations and close its direct sales unit.

Installations

Featured

Chemitek offers new cleaning products for floating PV

Huasun presents ‘zero busbar’ heterojunction solar modules with 23.8% efficiency

The Chinese manufacturer launched two new module series for utility scale applications. The new products feature a temperature coefficient of -0.24% per C and a bifaciality factor of over 85%.

South Korea offers support for agrivoltaics

The South Korean government has announced a new package of measures to support agrivoltaic projects. It says that the agrivoltaics business should be a priority for agricultural companies.

Globeleq acquires stake in 25 MW Egyptian solar plant

London-based Globeleq has acquired a 48.3% stake in the 25 MW Winnergy solar plant in Egypt’s Benban Solar complex. It will now cooperate on the management of assets and the operation of the facility with Egyptian manufacturer GILA Altawakol Electric.

Electricity prices rising in most European markets

AleaSoft Energy Forecasting recorded electricity price increases in most major European markets during the third week of April. It says prices could continue to increase in the fourth week of April, due to rising electricity demand.

DualSun launches foldable plug-and-play solar kits

France’s DualSun has developed foldable plug-and-play solar kits with a power range of 420 W to 1.68 kW.

Technology

Sodium-ion battery could charge in several seconds

GameChange Solar, JZNEE to build 3 GW tracker factory in Saudi Arabia

GameChange Solar, a US-based tracker supplier, has announced the construction of a 3 GW tracker factory in Saudi Arabia, with plans for potential expansion to 5 GW in the future.

Solar-assisted heat pumps vs. air-source heat pumps

A group of researchers in Iran has analyzed the coefficient of performance and the energy consumption of a solar-assisted heat pumps and an air-source heat pumps and has found that three factors are crucial to determine their annual performance – irradiance changes, ambient temperature, and wind speed.

NREL updates interactive chart of solar cell efficiency

The US National Renewable Energy Laboratory (NREL) has updated its research cell efficiency chart for a range of PV technologies.

Kaco launches new inverters for complex roof architectures

The new products are intended for applications in commercial and industrial PV projects. The devices feature an efficiency rating of up to 98.1% and a European efficiency of up to 97.8%.

Anker Solis launches residential batteries

The new X1 can operate inside or out, from -20 C F to 55 delivering what Anker says is 100% power output without derating. The batteries are lithium iron phosphate (LiFePO4) and will reportedly remain fully operational for up to 3,000 charge cycles.

Manufacturing

Featured

JinkoSolar posts $1 billion net profit for 2023

French module makers request permits to build GW-scale panel factories

Carbon and Holosolis have both requested construction permits for 5 GW solar panel factories in France.

Trina Solar claims 740 W output for TOPCon PV module

The Chinese manufacturer said Germany’s TÜV SUD has confirmed the results.

Chinese PV Industry Brief: China’s cumulative PV capacity tops 660 GW

China’s National Energy Administration (NEA) says the nation installed more than 47 GW of solar in the first three months of this year.

European Parliament approves law to ban products made with forced labor

The provisions cover all products and do not target specific companies or industries. They will be published in the Official Journal of the European Union tomorrow. EU member countries will have three years to enforce them.

Low solar module prices affecting secondhand market

Stefan Wippich, the CEO and co-founder of Germany’s SecondSol platform, recently spoke with pv magazine about the development of the used PV module market. Wippich noted national differences and argued that it will be important to set rules for the trading of secondhand products.

Energy Storage

Featured

Battery makers oversubscribe India’s latest 10 GWh tender

Australia announces community battery rollout

The Australian federal government’s initiative to install 400 community batteries across the nation has reached the Australian Capital Territory, with plans for three new battery energy storage systems.

Spain launches 1.3 GW synchronous renewables, storage tender

The Spanish authorities are seeking 1.3 GW of clean energy and storage projects to provide flexibility, stability and security to the national electricity supply.

The Hydrogen Stream: Denmark may produce green hydrogen from wind

Denmark will procure at least 6 GW of offshore wind power capacity to potentially produce hydrogen, while Orlen says it will use a European Commission grant to build 16 hydrogen refueling stations in Poland.

Large-scale solar, battery storage hybrid starts operations in South Africa

Norwegian PV developer Scatec ASA has switched on a hybrid solar and battery storage facility in the Northern Cape province of South Africa.

Johnson Controls releases new residential heat pump series

The new heat pumps use R-454B as a refrigerant and are specifically designed to be matched with Johnson Controls’ residential gas furnaces. Their size ranges from 1.5 tons to 5 tons and their coefficient of performance (COP) spans between 3.24 and 3.40, according to the manufacturer.